Factors

Factor Tilt Regime—October 2023

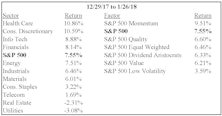

The dominating and overwhelming gains by the Magnificent Seven have made it nearly impossible for most traditional equity factors to excel. Only two styles have managed to surpass the S&P 500’s YTD return: Growth and Quality—and both have healthy exposures to the Magnificent Seven.

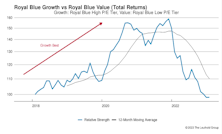

Growth vs. Value vs. Cyclicals

Both Growth and Value Small-Cap style boxes gained 10% in January’s rally. However, SC Growth remains well in the rearview mirror since its relative strength peak in September 2020: Small Cap Growth +8% versus Small Cap Value +60%.

Factor Returns And A Basket Of EGGs

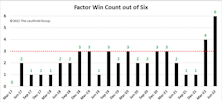

Equity factors are characteristics that have historically generated excess returns relative to the universe of stocks. However, in recent years factor returns have been underwhelming, causing investors to wonder if factors have become too popular, too crowded, or just plain obsolete. Then came the second quarter of 2022, when all six major factors outperformed the S&P 500, a feat only accomplished in four quarters over the last 27 years!

Research Preview: Factor Cyclicality

In Q2, all six major style factors outperformed the market. Those results are especially remarkable considering that factor excess returns the past few years have been underwhelming to the point that some investors began to wonder if they still work.

Factors Reverse Alongside Market

With equities rallying off bear market lows, factors also reversed during July. Except for Profitability, every factor category performed inversely to their year-to-date results. Momentum and Low Volatility were the biggest losers, while Growth was the biggest winner.

Tis The Season For Factor Tilting

Factor investing has gained wide popularity in recent years, enabled by a proliferation of smart-beta ETFs coming to market, which opened new opportunities for tactical investors. In 2018, we launched our Factor Tilt ETF strategy, and here we discuss how we’re now enhancing it by adding Seasonal Cyclicality to our analytical toolbox for evaluating factor conditions.

Factors: Ain’t Misbehavin’

Investment styles and factors are generally interpreted as having an inherent preference for either bullish or bearish market environments. The theoretical tilt of each style is based on its design and its sensitivity to economic, profit, and valuation cycles. However, theory and practice do not always agree, and we must look to actual performance to confirm our impressions.

Research Preview: Factor Standings For 2020

As we review factor and style returns for 2020, it occurs to us that the “whole” is much less interesting than the sum of its parts. Many factors are considered to be either bullish or bearish in temperament, and last year’s round-trip offers an opportunity to test the reliability of those characterizations.

Podcast #25 - Anything But Growth

Driven by massive government stimulus, an imminent vaccine rollout, and the expectation of record earnings in 2021, investors seem to be on the verge of embracing a move away from Large Cap Growth stocks in earnest. The leading candidates offered as broad-based alternatives to Large Growth (LG) include Value, Small Caps, and Emerging Markets.

Leuthold Factor Tilt Update

Factor analysis is a point of emphasis in Leuthold’s tactical research activities, and this note summarizes our Factor Tilt outlook going into the fourth quarter. Factors are return drivers such as Value, Momentum, and Quality, and research has found that factor results vary over time—but that does not mean they are random.

Siege Protocol

This study examines the traditional protocol for bear markets to find which tactics worked as expected and which were caught misbehaving. Overall, we conclude that investors were not ready to commit to a full leadership rotation.

Factor Failure: Don’t Blame FANMAG

Our recent commentary “1” For The Record Books noted that just one of seven S&P smart beta factors was able to outperform the S&P 500 last year, even though each style basket limits its holdings to constituents of the parent index.

“1” For The Record Books

Dark energy makes up 68% of the universe, yet astrophysicists are having a devil of a time explaining what it is, why it is, or how it works. Quant investors are facing their own dark-energy mystery in understanding style returns of 2019.

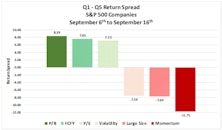

The Case Of The Flipping Factors

Equity market themes have been boringly consistent of late; growth beating value, large beating small, and domestic beating international. In the factor world, Momentum and Low Volatility have been investor favorites for most of 2019 while Value resided in last place – the same old, same old. Then, something remarkable occurred on September 9th.

The Odd Couple

The Momentum style—in which investors buy what has been going up recently—represents an optimistic, hopeful, “I’ll take some of that” mentality. The Low Volatility factor entails a pessimistic, fearful outlook in which investors want (or need) to stay invested in stocks but desire downside protection in case the market performs badly.

Horse Trading In The Factor Zoo

Smart beta ETFs have become an immensely popular investment tool, attracting billions of dollars in AUM by providing investors with targeted exposure to factors such as Value, Momentum and Quality. Characteristics such as these have been shown to generate alpha over time, and investors understandably wish to have focused positions in these return-generating styles.

Factor Trade-Offs

A major difficulty in picking stocks based on quant factors is the need to make trade-offs. A company that looks attractive on one preferred metric will likely look unattractive on another. This study examines the uncomfortable give-and-take that complicates factor investing at the stock level.

Factor Tilts at Mid-Year

Factors provide investors with the ability to shift their portfolio’s characteristics to fit a particular economic and market outlook. Value might look appealing under one set of conditions while Quality might be more desirable in another. We developed a research platform that analyzes various drivers of factor returns, summarized in Exhibit 1.

Can Smart Analysts Generate Smart Beta?

We assess the effectiveness of using Wall Street analyst opinions as factors in a quantitative stock selection model. Watch for the full report coming next week.

Factor Frontiers And Investing To The Max

Quantitative investing has taken the industry by storm over the last decade, and smart beta ETFs are pulling in billions of dollars as investors and advisors gravitate to this portfolio management technique.

Momentum Buyers: Beware

Momentum is a smart beta factor that gives investors excellent upside participation in rising markets. Most other smart beta factors are defensive plays, so Momentum is the place to be in strong upward moves. Momentum filled that role admirably in recent years, rising 56% from 2016 to the September top, compared to an average of +26% for the other major factors.

Styles And Factors DeFANGed

Social media, mobile computing, and digital life-in-the-cloud were the dominant storylines for U.S. stocks over the last five years—reaching the apex of popularity following the early-2016 market low.

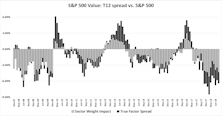

Factors And Sectors: A Curious Entanglement

Portfolio managers who tilt toward Value or Growth stocks have long known that each style carries with it an inherent bias toward some sectors and away from others. Our recent piece, Value Style’s 100-Year Flood, highlighted the significant role that sector weights (overweight Financials and Energy, underweight Technology) played in Value’s decade-long stretch of underperformance.

Research Preview: Sector-Adjusted Factor Returns

This article summarizes our current research into the interaction between factors and sectors. We find that sector weights have a significant influence on some factor results, while the true factor impact is the key driver for others. Watch for our full report coming next week.

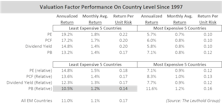

EM Country Rotation Based On A Stock Factor Model

Back testing shows stock-level factor alpha can be captured at the country level. With the rapid growth of single-country ETFs, this may prove an efficient, practical alternative to individual stock selection.

The Ups and Downs of 2018

Ten weeks into 2018, we have already seen three mini-cycles in U.S. equities. A rip-roaring surge in January was followed in early February by one of the shortest corrections in history...

Leverage Factor: A Boost For High Quality Stocks?

A review of Quality factors, as well as the lower valuations of High Quality stocks, supports the current High Quality cycle amid rising market volatility. The Leverage factor may provide particularly strong backing for High Quality stocks.

Factor Mapping: The Final Piece Of The Puzzle

This months-long research effort culminates with this commentary as we lay out our thoughts on factor rotation and introduce The Leuthold Group’s recently launched Factor Tilt strategy.

A Tactical Approach To Successful Factor Investing

Executive Summary

- Factors are investment characteristics that represent anomalies under the Capital Asset Pricing Model (CAPM). Securities possessing these desirable traits earn excess risk-adjusted returns beyond those predicted by CAPM.

Coming Attractions

With an abundance of year-end updates in this edition of Perception for the Professional, we plan to release the content for this “Of Special Interest” section separately in mid-January.

Sector Rotation: Momentum Versus Valuation Factor

For sector overweight/underweight decisions, applying a Momentum overweight with both EM and DM countries has been most successful.

The Case Of The Disappearing Value Premium

Market history teaches us that investors behave differently in groups than they do as individuals.

Valuation-Based Country Selection/Rotation

Despite cyclicality, over the longer term, investing in lower valuation countries ekes out better performance in an EM portfolio, and Dividend Yield showed the most consistency in terms of value factor effectiveness.

Momentum-Based Country Rotation: EM Vs. DM

Last month we assessed the effectiveness of using valuation factors as a basis for country allocation. Using 20 years of data, our results showed that they work quite well specifically for Emerging Market (EM) country-rotation, however, the same valuation-based strategy does not appear to be value-added for Developed Market (DM) allocation/rotation.

Valuation-Based Country Rotation: EM Vs. DM

Many studies have evaluated momentum factors for over/underweighting country exposures within a portfolio, but few have considered valuation factors for country rotation within the Emerging Market space.

July Factor Performance

With the exception of Low Volatility and Profitability, all other factor categories produced positive factor performance in July. The month was eventful, however, as Momentum produced a +4% spread through July 12th, only to give up more than half of that advantage as interest rates rolled back over.

Rotation From Info Tech To Financials Drives Factor Performance

Factors were impacted in June by: 1) Information Technology underperformance; 2) Financials’ renewed strength; and, 3) defensive and low volatility stocks lagging.

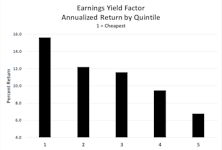

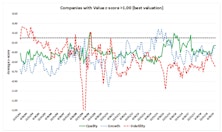

Dynamic Factor Investing: A Study In Value

Investment factors experience performance cycles just like every other asset and index. The Value factor is robust across definitions, as all eight versions produced positive excess returns under long/short and long-only methodologies.

The Intelligent Use Of Smart Beta

Quantitative investing has become an integral component of professional investment management, and smart beta funds have become popular vehicles for advisors as they assemble actively-managed client portfolios.

In Uncertain World, Investors Reward Growth

With the “Trump Trade” in question, investors have been flocking to companies delivering tangible results.

.jpg?fit=fillmax&w=222&bg=FFFFFF)

_Page_1.jpg?fit=fillmax&w=222&bg=FFFFFF)

.jpg?fit=fillmax&w=222&bg=FFFFFF)

.jpg?fit=fillmax&w=222&bg=FFFFFF)

_Page_1.jpg?fit=fillmax&w=222&bg=FFFFFF)