Bubbles

The 2021 Speculative Mania And Its Aftermath

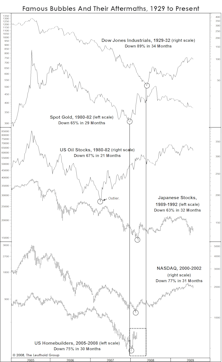

One of the societal benefits of recessions and bear markets is that they serve to correct the unhealthy excesses that build up in overheated economic booms and overly enthusiastic bull markets. As market historians, we believe it is instructive to look back at cycles of excesses and their corrections to learn how such patterns evolve and, quite often, repeat themselves.

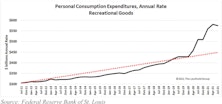

Discretionary Durables: A Bubble In Fun

Extremely loose monetary and fiscal policies during the pandemic have created distortions and disequilibria throughout the economy. The most visible bubbles may be in financial markets, evidenced by the boundless valuations applied to visionary startups and the speculative fascination for digital assets of all types. This report examines a bubble of a different kind; not a financial bubble but rather a real-world bubble in “fun”. Producers of recreational goods are flourishing during the pandemic, posting massive sales gains and a tripling of net income, yet selling for miniscule valuations.

Research Preview: Discretionary Durables

While retail spending has boosted staples and durables alike, we believe that discretionary durables have been the prime beneficiary of changing lifestyles and spending patterns, with skyrocketing sales and inventory outages that may not reach equilibrium even in 2022.

Carbuncles, Diamonds, and Tears

High growth rates, innovation, and disruption are defining traits of the companies that have powered the market to recent highs, and the ARK Innovators Fund (ARKK) is an example of today’s enthusiasm for visionary growth stocks. Recent returns and growth in AUM have been nothing short of spectacular, and ARKK has become symbolic of today’s style of new-era growth investing.

Inflation In The Wrong Places?

Long before policymakers’ extreme response to the COVID collapse, we feared that the Fed’s interventions were suppressing important signals from the stock and bond markets. But we now suspect that hyper-expansionary policies are suppressing price signals from the “real” economy as well.

A Storied Bubble’s Pearl Anniversary

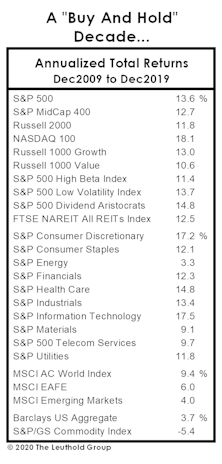

The decade of the teens has given way to the decade of the twenties and “year in review” retrospectives are in the books, but as the calendar’s last digit rolls from 9 to 0 we consider one more anniversary worth remembering.

A New Year, Or A Blast From The Past?

It was during the very first days of the great 2019 market rally that we noted its similarities to the bubbliest of all the bubble years—1999. Wow. We had it in our hands and frittered it away.

Fondly Remembering The Year 2000...

Many equity investors have suggested there’s no comparison between today’s expensive market and the bubble peak of Y2K, pointing out that today’s Technology titans are “real companies” with massive revenue underpinnings.

Housing: Just Like The Bubbles Before It

Sectors that become the object of obsession during one economic cycle tend to remain cyclically depressed in the following one.

Housing Hangover: May Linger Longer Than You Think

Housing stocks, and the enablers that helped create the bubble (Financials), are following the usual pattern of busted bubbles. After the bust, these past bubbles typically see a beta bounce establishing post crash highs. After that, it can take many years before these highs are again broken.

Cyclicals: Getting All The Respect Of Financials

The Morgan Stanley Cyclical Index: a group we didn’t recognize as a bubble two years ago (and we suspect we’re not the only ones), but one that meets the minimum requirement for “membership” by declining at least 70% from its high.

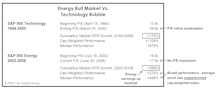

Busting Up Bubble Talk

More bubble talk. Crude oil prices are following the same pattern as the tech bubble in the late 1990s. However, Energy stocks have not become nearly as extended as Tech stocks were in the late 1990s. Also, Energy stocks have shown far superior earnings growth compared to Tech.

Homebuilders.....Watching The “Window”

Not all gloom and doom this month...Homebuilders approaching window where past busted bubbles have bounced.

View From The North Country

The persistent rise in short term rates could have a big impact on the consumer. The rising prime rate has boosted debt service costs substantially, and “Financial Death Traps” may be on the horizon.

View From The North Country

Steve Leuthold lays out both the bullish and bearish stock market cases.

View From The North Country

Still expect to see market correction develop in coming weeks. Based on past market dynamics, a correction in excess of 5% is overdue, considering it has been almost 12 months of uninterrupted market upside.

.jpg?fit=fillmax&w=222&bg=FFFFFF)