Bull Market

Premature Aging?

If today’s stock market is indeed a new bull, its vital signs advise that it is more in need of a coffin than a cradle. Monetary policies, both in terms of rate hikes and the inverted curve, have never been more hostile at this stage of a major stock market upswing.

Waking From A Slumber?

We’re very skeptical that the rally from last October’s low represents the first leg of new bull market. But if it is—as many believe—then it has unquestionably inherited the worst set of genes we’ve ever observed in the species.

Calling “Bull” On Calls For A New Bull

Seriously, another “new bull”—coming so quickly after this summer’s “new bull?” We’ll see. We’re not ones to dismiss price action, because stock prices, in and of themselves, are an important “fundamental.”

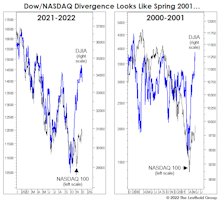

But we’ve seen the Dow go rogue like this once before, and it didn’t end well.

“Toro Nuevo” Or Mirage?

While our breadth measures do not consider this rally to be thrust-worthy, when based on nothing more than performance, it’s difficult to distinguish between the “first up-leg” in a new bull market and a bear-market rally. The vital signs at present appear to be more in-line with the latter (although making that conclusion based on price action, alone, is hardly better than a coin toss).

Welcome To The Terrible Twos!

In late March, the S&P 500 came close enough (3.5%) to its January high that a second birthday celebration for the bull seemed warranted. Who doesn’t love a party? But, as we noted in a recent Chart of the Week, a milestone like this is a good excuse to haul our pet to the veterinarian for a checkup.

The Bull Visits The Vet

Just after yesterday’s close, we loaded our precocious bull into an SUV and drove to the local veterinary clinic for a two-year checkup.

Our bovine buddy drew some sympathetic stares while we were waiting in the lobby. Noting our bull’s droopy eyelids and gray facial hair, an assistant informed us, “You know, you didn’t actually need to bring him here. We now have a mobile euthanasia service.” We just smiled, and waited for the veterinarian, who is said to be a specialist in this new super-species of bull.

Let Us Add To The Bullish Cacophony

It’s been a heck of a stock market year, and there are still four months left. What else could go right? Monetary conditions, for one thing—at least as proxied by our Dow Bond Oscillator (DBO).

Young Bull, Old Threat

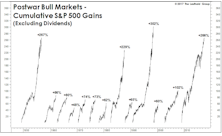

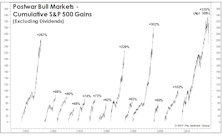

By our count, the current bull market is the 13th of the postwar period. The 88% gain achieved by the S&P 500 in less than 14 months already places this bull sixth in terms of cumulative gains. We considered it a hindrance that this bull commenced from higher valuation levels than any other in history. Instead, they seem to have provided a head-start.

A Fast Start Comes At A Big Price

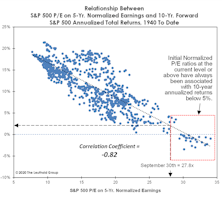

The first up-leg of the bull market has catapulted many Large Cap valuations to levels seen only in 1999, 2000, 2019, and pre-pandemic 2020. At the six-month point on September 23rd, the S&P 500 P/E on 5-Yr. Normalized EPS had already reached 26.9x—a reading that is 30% higher than at the same point of any other bull market.

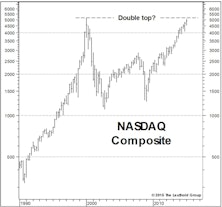

Back To Y2K?

The bull market took out another old record last month when the S&P 500 topped the cumulative total return of the 1949-56 upswing. The total return since March 9, 2009, is now 468%. Since the highs of March 2000, the S&P 500 cumulative total return is actually a few basis points behind U.S. 10-year Treasury bonds.

Can New Reins Take Hold Of An Old Bull?

Three months ago, Large Cap Growth and Momentum were the winning ways to play the market; the long-time resiliency of these entrenched leaders was a cornerstone of the bullish case. Suddenly it’s Value and Deep Cyclicals leading, anything possessing Momentum, of late, has turned toxic. Ironically, this “new” leadership is now the foundation for the bullish reasoning.

Bull Markets Are In The Eye Of The Beholder

The market’s four-month recovery from the brink of a bear was completed in April, and the ten-year-old bull looks better than ever against all of its post-World War II competitors.

Yet Another Anniversary?

We received two media calls in December hoping we would comment for upcoming special features about the tenth anniversary of the bull market. We rolled our eyes.

The Commodity Bull That Equity Investors Missed...

While the bottom-line impact may ultimately be the same, there’s one thing we find more demoralizing than getting the direction of an asset wrong: getting the direction right and not getting paid for it.

Where’s The Spring In The Step?

Old age alone may not kill the bull, but it can make it more susceptible to an array of life-threatening maladies.

A New Hurdle For An Old Bull?

The first quarter S&P 500 earnings “beat” rate stands to be the highest in history, as any CEO with a pulse has learned to lower the hurdle.

This Is A Head-Scratcher

The longest and probably most complex bull market in history is not going to make a clean and decisive exit.

Nine Corrections In Nine Years

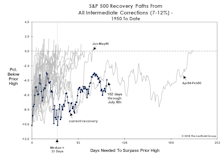

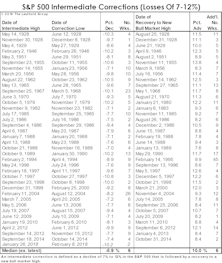

The stock market’s nine-day decline off its January 26th high met our definition of an intermediate correction—an S&P 500 loss of between 7-12%.

Late In Bull Market, But Not Terminal

The bull market continues to behave like one that’s in a late—but not terminal—phase. After a stumble late last year, the Momentum leaders have already reasserted their dominance, opening up a four percent lead on the Value stocks YTD after crushing them in 2017.

Cashing In A Few Chips

Through early August, the S&P 500 had matched last year’s total return gain of 12%, while futures on that index have gained more than 20% from their after-hours lows made on election night.

A “Good Year” To Start The Year

The S&P 500 was up 6.4% YTD through March 3rd, a bit above its average annualized gain of 5.9% since 1926. In other words, 2017 would be a good year if the books were closed today.

Bull Market Continuation Signal?

The stock market looks overbought on virtually every technical measure we can think of, but an overbought condition doesn’t always mean the market is vulnerable. To the contrary, we’ve found that “initial” overbought readings—like the one triggered last week on the S&P 500’s 14-Week Relative Strength Index—are generally followed by above-average gains in the intermediate-term (Chart).

Stock Market Observations

The Major Trend Index stabilized in a moderately bullish range during the past several weeks, yet the Momentum/Breadth/Divergence category is almost the sole carrier of the bullish torch.

Tracking The Stock Market Top

While the sequence of index peaks traced out YTD is not exactly a textbook one, the market’s internal diffusion is comparable to that seen at many major tops, including 2000 and 2007.

Another Retrospective On The Bull…

Up front, we need to remind readers that the Major Trend Index is bullish at 1.08, and our tactical funds remain well-exposed to equities with net exposure of 60-61% (versus a range of between 30% minimum up to a maximum of 70%). That being said, we’re focused on the likelihood of a major defensive portfolio move in the near future, which probably comes as no surprise to Green Book readers (...what with us publishing a prepackaged obituary for the bull market just a month ago).

Spring Fever?

We remain reluctant stock market bulls, with our disciplines supporting net equity exposure (targeting 55%) that “feels” too high based purely on instinct. We think our stay in the overcrowded bull camp will be short-lived.

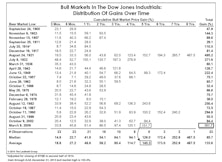

The Bull Market Turns Six

The bull’s 72-month lifespan now rates as the fourth-longest among all 23 DJIA bull markets since 1900, and the cumulative price gain of +179% ranks sixth.

Still More Bull Market Milestones…

Mario Draghi will commemorate the global bull market’s sixth anniversary on March 9th with the initiation of a QE bond purchase program of 60 billion euros per month. Our own celebration has been subdued by comparison.

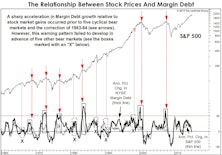

Margin Debt Revisited

Stock market Margin Debt enjoyed a brief phase of notoriety when it eclipsed its 2007 high just over a year ago, then it retreated into obscurity. Now it may finally be telling us something.

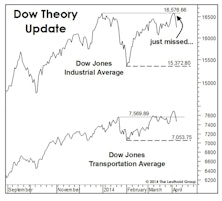

Canary In The Coal Mine?

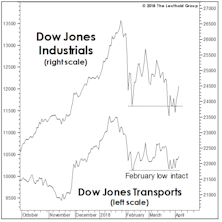

The S&P 500 made a cycle high on December 29th, and in early February mounted another assault on that level. Ignoring valuations, the economy, Europe, etc. (not necessarily our recommendation), the most bullish observations we can make about the stock market are: (1) its peak is still recent; and (2) the S&P 500 had significant company at that peak—including the Transportation stocks, Utilities, Russell 2000, S&P 500 Financials, and even the NYSE Daily Advance/Decline. All in all, this action is broad enough that a final top shouldn’t be imminent.

Topping Out… But Patience Required

Weight of the evidence suggests the bull market is in a broad topping process, likely begun in late-July. The duration, however, may be proportionate to the tremendous five-plus year upswing that preceded it.

Two For The Price Of One?

Think the bull market is long in the tooth at almost six years of age? Maybe not.

Story-Telling Time

Great bull markets begin with numbers but end with narratives. The current bull market began with terrific statistics, but the past two years has given way to story-telling that is unimaginative even by Wall Street standards.

U.S. Markets See Uniform Strength, While The World Seems Fractured

Based on the historical percentages, the bull market should have a minimum of four to six months of life left. But the market has a way of throwing sand in the gears when you think you’ve begun to understand its internal mechanics.

Bulling Through The History Books

The Dow Jones Industrials’ bull market gain of +150% is well ahead of the long-term median (+86%) and average (+134%), and places the 2009-to-date move as the sixth-best all time.

The Bull Market Turns Five

The post-2009 stock market upswing now qualifies as only the sixth cyclical bull market since 1900 to last five years or more. But only three of the previous five-year-old bulls lived to see a sixth birthday.

Industry Groups: No Need To Bottom-Fish

Buying global groups with strong price momentum has been a winning strategy. Will it continue?

A Comprehensive Look At The Emerging Markets: Diagnosis And Prognosis

We examine Emerging Markets from both the top-down and bottom-up perspectives as we try to identify where to move and what to expect. We check in on two successful EM thematic group ideas as well.

Summer Doldrums?

Give those who’ve advised investors to “Sell In May” over the years some credit: they’ve never been too specific.

Major Trend Index Fading As “That Time Of Year” Looms

With “That Time Of Year” approaching and the Major Trend Index not too far above the neutral zone, we review nine factors impacting the stock market from a glass-half-empty perspective.

.jpg?fit=fillmax&w=222&bg=FFFFFF)

.jpg?fit=fillmax&w=222&bg=FFFFFF)