Commodity

Lo And Behold, Another RATIO!!

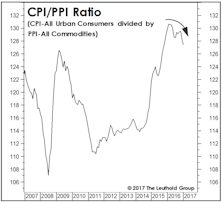

For managers who must remain fully invested in equities (or “paid to play,” as we’ve often called it), the level of inflation might prove a less important consideration than its character.

Another Take On The Inflation Debate

While there’s understandable obsession over the likely level of inflation (especially with the year-over-year CPI dipping below zero in the past two months), equity managers with no interest or skill in inflation forecasting might be better served by monitoring the character of inflation—i.e., whether it was led by changes in consumer or producer prices.

The EM Value Trap?

EM valuations look cheap in a stock market world that otherwise doesn’t. But even their “cheapness” bothers us.

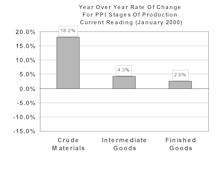

Inflation Pressures Becoming More Evident

All three PPI measures have their 6 month rates of change well above the 12 month rates, so the trend points toward even higher inflation ahead.

Inflation Update…..Consensus View Underestimating Inflation Prospects

Consensus view (2% inflation rate by year end), is underestimating inflation prospects. We forecast 12 month CPI rising to +3.0 to +3.5% by year end. If we are correct, inflation is not fully incorporated into current bond prices.

Leuthold’s Commodity Diffusion Index

The Commodity Diffusion Index is an outstanding inflation monitor and has also been a good gauge of future market performance.

Inflation & Interest Rates

Favorite stock groups now “inflation and interest rate proof”?