Consumer Staples

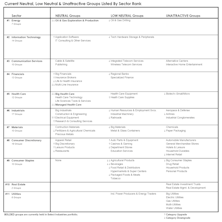

Rate-Sensitive Groups Dominate Unattractive List

Utilities, Real Estate, and Consumer Staples are the bottom three sectors among the GS Scores.

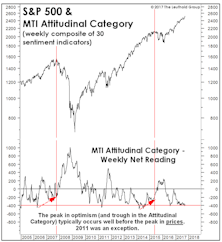

Altitudes Are Too High— And Attitudes Are Getting There

An important feature of this bull market—and a reason for its longevity—is the slow recovery in investor attitudes relative to valuation altitudes...

Attention Shoppers: Contrarian Plays In Aisle 3

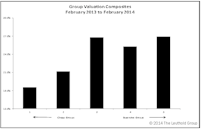

The 2017 run that pushed the nine-year bull market to all-time highs made it very difficult to find anything that looked cheap, and few choices that looked average. Even the Tech bubble of 1999 allowed investors to find moderately priced stocks among the mundane old-economy companies...

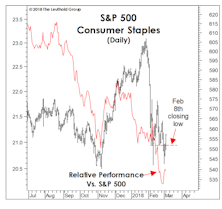

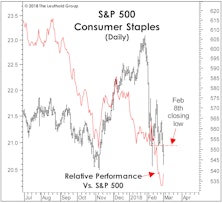

Staples Still Stomped Upon

Consumer Staples has historically been the sector most resistant to intermediate stock market corrections, exhibiting an average “downside capture” of less than 40% during all such declines dating back to 1989.

What’s Ailing Consumer Staples?

For the first time in this bull market, defensive stocks failed to provide any semblance of defense during a market correction.

What’s Ailing The Staples?

The setback that began in late January qualifies as the sixth intermediate correction of the current bull market, where “intermediate” is defined as an S&P 500 loss ranging between 7%-12%...

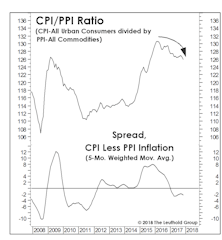

Keep An Eye On “Relative” Inflation

While our Group Selection (GS) framework hasn’t yet warmed up to commodity-oriented industries, our macro work suggests perhaps it should.

Thoughts On Sentiment

The MTI’s Attitudinal category has held stable over the last several months, an impressive (and contrarily bullish) feat considering the steady onslaught of new bull market highs.

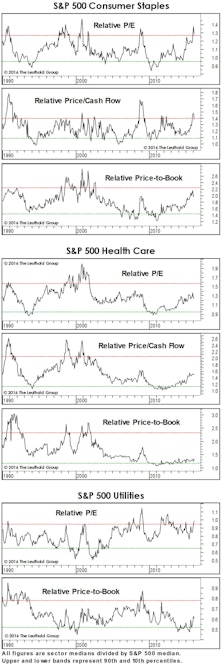

Still In Thrall With Low Vol

Ongoing investor obsession with stability strikes us as considerably more dangerous than the situation in the Tech sector. While many see market parallels with 1999, we instead see a mirror image.

Is Defense Overpriced?

Relative valuations of Staples and Utilities sectors already reflect a “flight to quality” effect. Investors looking to add some economic/stock market defense should focus on the cheaper Health Care groups.

Two Worrisome Bull Market Highs

Among the dozens of indexes we monitor, the year’s final all-time highs (S&P 500 Consumer Staples and S&P 500 Low Volatility Index on December 29th) can’t possibly provide any comfort to stock market bulls.

Late March Reversal… And The First Shall Be Last

We examine the impact of March’s strong group leadership reversal on the top and bottom of our group model.

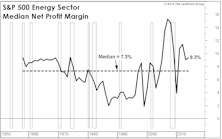

Profit Margins At The Sector Level

All ten of the S&P 500 sectors recorded a sequential increase in four-quarter trailing net profit margins. But consider where sector margins stand today relative to their 25-year medians. Eight of ten S&P 500 sectors are recording profit margins well above their long-term medians.

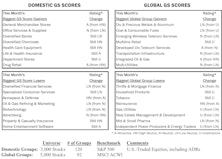

Group Models: Info Tech Tops Domestic, Financials Remain Atop Global

Both models have numerous Information Technology and Financials groups in Attractive territory. Neither model has any Unattractive Tech groups. Alternatively, neither model has any Attractive Utilities groups, while several Utilities rate Unattractive in each.

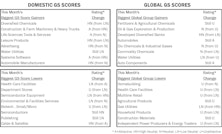

Group Models: Info Tech Tops Domestic, Financials Tops Global

Both models (particularly domestic) have a number of Attractive rated Information Technology groups and no Unattractive rated Tech groups. Financials’ domination of the Global Attractive range continues.

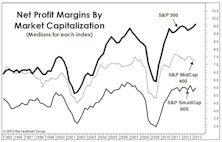

Sector Margins: Just Thank The Consumer

We’ve noted before that profit margin gains since the technology boom have been primarily a Large Cap phenomenon.

A Comprehensive Look At The Emerging Markets: Diagnosis And Prognosis

We examine Emerging Markets from both the top-down and bottom-up perspectives as we try to identify where to move and what to expect. We check in on two successful EM thematic group ideas as well.

Group Models Agree On Energy & Materials

But Information Technology rises to the top of the Domestic model, while the trend of Financials domination in the Global model remains intact.

Domestic and Global Group Models: Strong Agreement On Financials

Our Domestic Scores have five Financials groups rating Attractive; these same five industry groups are Attractive in our Global model. In total, seven Financials groups rank Attractive in the Global model, with insurance groups looking particularly Attractive.

A Contrarian Call For The Second Half

With the notable exception of the Consumer Discretionary sector, cyclical stocks topped out globally on a relative basis in early 2011 (Chart 3). Throughout the last two and one half years, there have been repeated calls for industrial cyclicals—which were, of course, the leaders of the last cyclical bull market—to reassume stock market leadership.

Domestic and Global Group Models: Strong Differences On Consumer Staples

Consumer Staples are top-ranked in the domestic model but appear particularly Unattractive in the global model, which continues to be dominated by the Financials.

Leadership: More Of The Same?

Market valuations and investor sentiment are a bit too inflated for our comfort, but the catalyst of the MTI’s drop to Neutral status two weeks ago was simply the action of the stock market itself. Specifically, we haven’t liked the disjointed nature of U.S. market action since about mid-March, where high-yielding and economically-defensive stocks have done the heavy lifting in the Dow and S&P 500 moves to all-time highs. This isn’t so much a change in leadership as an acceleration of an existing trend, and it’s now pronounced enough to weigh down a few of our technical measures.

Nice Gains… But In The Wrong Groups

Sure looks like a bear market rally rather than start of new bull market. Many global indexes still down 20% or more from peak levels.

The Consumer Is Reviving… But Sell The Stocks

The game is now over for Discretionary, and this opinion is supported by the sector’s decline to the bottom of our GS Score ten-sector composite.

Thoughts On Asia Investing: Performance & Valuation of Consumer Stocks

A look at Asian valuations show China to be fairly valued (neither overvalued nor undervalued), but there are other attractive (cheap) ways to play consumer stocks in Asia.

Consumer Goods Stocks Versus Commodity Stocks: Identifying Long-Term Leadership

Are we asking the wrong question about Consumer Stocks versus Staples? This month’s “Of Special Interest” looks at the relationship between all Consumer groups (both Discretionary and Staples) compared to Commodity related groups.

Digging Into Consumer Groups

An analysis of underlying factors that may be hindering the consumer groups, both “discretionary” and “staples,” from making a showing in our Attractive rankings.