Contrarian

Our Most Contrarian Industry Group Ideas

Contrarian investing is difficult from both an emotional and implementation standpoint. Often the consensus is right, and industry groups are out-of-favor for a reason. As the saying goes, “Don’t be contrarian just for the sake of being a contrarian.”

Central Planning Makes A Comeback

Bulls who fashion themselves as contrarians argue that the public is nowhere near as infatuated with the stock market as they were in the late 1990s. It may come as a shock to our readers, but we agree with them.

Are You Really A Contrarian?

The need to sound contrarian has become a borderline obsession among market pundits. Media opportunities for talking heads have exploded in the last decade, forcing those who hold the safest consensus views to falsely portray themselves as lonely and misunderstood market mavericks.

Our Most Contrarian Group Ideas

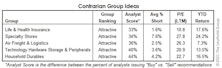

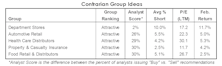

We use our Group Selection (GS) Scores to identify the potential for a catalyst, and to gauge the health and future performance potential of those groups out of favor by analysts.

Our Most Contrarian Group Ideas

Using “Analyst Score” to measure sentiment and our Group Selection (GS) Scores, we present what appear to be the most quantitatively Attractive, yet disliked equity groups.

The Dreams & Nightmares Of 2013

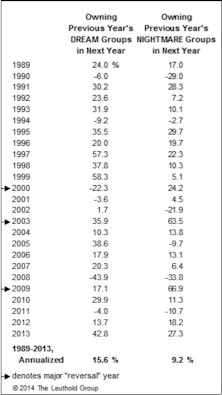

For 25 years we’ve tracked hypothetical industry group portfolios comprised of the previous year’s “Dreams” (20 best performers) and “Nightmares” (20 worst performers).

Everyone's A Contrarian!

The analysis of stock market sentiment is an area that’s become especially prone to selective perception, what with the explosion in creative, New-Economy ways to measure investor mood (Twitter activity, Google searches on key phrases, etc.). By the sheer law of large numbers, a market commentator with any view whatsoever can now ferret out enough data points or market anecdotes to paint him/herself as a maligned and misunderstood contrarian.

Historical Sentiment Measures Not Showing Signs Of Bottom

In looking at Contrarian indicators compared to past major market lows, it seems today’s market has more room on the downside.

View From The North Country

I cannot recall another time when professional stock market opinion was so universally bullish regarding the coming year.

View from the North Country

Perception of Stock Market Risk Has Increased Significantly...Notes from the Recent Contrarian Opinion Forum...Program Trading Controls

View from the North Country

The crowd is not always wrong and being contrary is not always right. However, maintaining the ability to step away from the crowd is crucial. Our once lonely positive stance toward consumer stocks seems to now be consensus, but that in itself is not reason to now abandon the thesis. It does, however, put us on guard.