Core

Core & Global Asset Allocation Portfolios

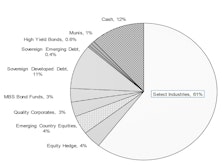

Major Trend Index strengthened in April; net equity exposure increased to 61%

Core & Global Asset Allocation Portfolios

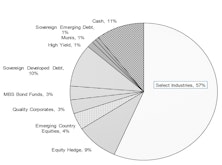

Major Trend Index Neutral: Equity Exposure Remains 52-53%

Core & Global Asset Allocation Portfolios

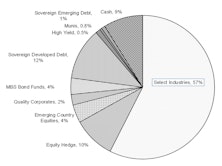

We increased equity exposure back above 50% in mid-November as a result of the MTI returning to Neutral.

Core & Global Asset Allocation Portfolios

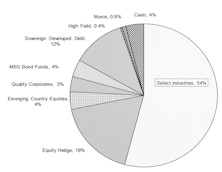

Major Trend Index turned negative and as of early October, we are now targeting 40% net equity exposure.

Core & Global Asset Allocation Portfolios Competitive With Benchmarks Despite Maintaining Reduced Equity Exposure

Net equity target is 55%; waiting for clearer signal from our Major Trend Index (currently rated Neutral).

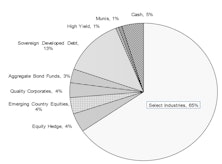

Core & Global Asset Allocation Portfolios’ Net Equity Exposure Unchanged At 65-66%

Both Portfolios lagged all-equity benchmarks in June; but still ahead YTD.

Core & Global Asset Allocation Portfolios’ Net Equity Exposure Unchanged At 65%

Both Portfolios matched their all-equity benchmarks in May, and are outperforming YTD.

Core & Global Portfolios Net Equity Exposure Unchanged At 64-65%

Both Portfolios ahead of their all-equity benchmarks YTD.

Core & Global Portfolios Equity Exposure Unchanged In April

The Major Trend Index remains positive, and our portfolios continue outpacing the market. Net exposure is 65% in both the Core and Global portfolios.

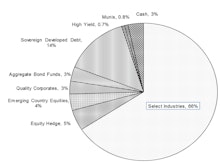

Core & Global Portfolios Equity Exposure Increased Slightly In February

The Major Trend Index remains positive, and net exposure is 65% in the Core and 64% in Global.

Core & Global Portfolios Equity Exposure Maintained In January

The Major Trend Index remains positive and net exposure is 63% in the Core and 62% in Global.

Core & Global Portfolios Equity Exposure Maintained In December

The Major Trend Index remains positive and net exposure in both portfolios is 64%. For all of 2013, our average net equity exposure was 60% in each portfolio.

Core & Global Portfolios Equity Exposure Raised Slightly As Hedge Reduced

The Major Trend Index remains positive and, as expected, our temporary ETF hedge was lifted. Our net exposure in both portfolios is now 64%-65%.

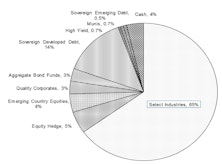

Core & Global Portfolios Equity Exposure Trimmed Slightly To 60%

The Major Trend Index remains positive, but we reduced our target exposure from 62% to 60% using a short ETF as we believe this position will be temporary in nature.

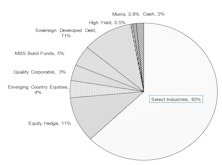

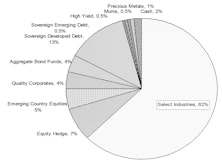

The Asset Mix - October 2013

Core, Global, and Asset Allocation Portfolio overviews.

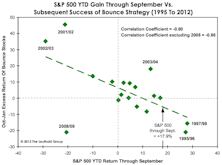

Playing The Bounce - With A Twist

The historical batting average of this strategy has been decent, with gains in 9 of 18 years along with “excess” returns over the S&P 500 in 10 of 18 years. The best Bounce seasons have occurred when the market was either down for the year through September, or up only modestly.

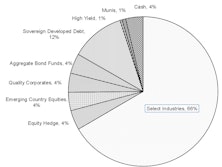

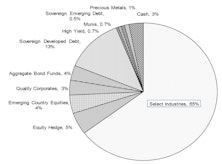

The Asset Mix - September 2013

Core, Global, and Asset Allocation Portfolio overviews.