Countries

Momentum-Based Country Rotation: EM Vs. DM

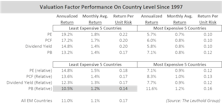

Last month we assessed the effectiveness of using valuation factors as a basis for country allocation. Using 20 years of data, our results showed that they work quite well specifically for Emerging Market (EM) country-rotation, however, the same valuation-based strategy does not appear to be value-added for Developed Market (DM) allocation/rotation.

Valuation-Based Country Rotation: EM Vs. DM

Many studies have evaluated momentum factors for over/underweighting country exposures within a portfolio, but few have considered valuation factors for country rotation within the Emerging Market space.

MSCI EM Reclassification: Achiever & Aspirers

EM segments on the “Aspirer” watch list for MSCI annual market reclassification: China A-shares and Argentina. The “Achiever,” Pakistan, just recently started trading as a new member of MSCI EM Index.

Disentangling Industry & Country Effects In A Global Equity Portfolio

Each of these effects has diminished in importance over time, but it’s still worth taking a look. Momentum is best at capturing the Industry effect, while Valuation works best at the Country level.