COVID

How It All Went “Down”

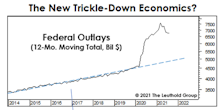

The COVID rescue plan has generated a multi-trillion-dollar deluge of federal spending that has trickled down to government transfer payments, personal incomes, retail sales, and surging EPS. When considering all of these data series in relation to their long-term trends, it’s truly remarkable that the only item analysts consider to be “transitory” is inflation.

Factors: Ain’t Misbehavin’

Investment styles and factors are generally interpreted as having an inherent preference for either bullish or bearish market environments. The theoretical tilt of each style is based on its design and its sensitivity to economic, profit, and valuation cycles. However, theory and practice do not always agree, and we must look to actual performance to confirm our impressions.

Research Preview: Factor Standings For 2020

As we review factor and style returns for 2020, it occurs to us that the “whole” is much less interesting than the sum of its parts. Many factors are considered to be either bullish or bearish in temperament, and last year’s round-trip offers an opportunity to test the reliability of those characterizations.

Revisiting The “Reopening Economy” Theme

We review relative price-action patterns among industry groups belonging to the “reopening economy” theme. These are areas that have been hit hard by the pandemic and should benefit the most from a return to economic normalcy. Conversely, a variety of industries profit on days when it appears that the economic shutdown may be prolonged. Recent performance is incorporated to re-examine the trends.

Podcast #22 - An Economic Pandemic Divergence

Although COVID-19 has significantly impacted everyone, its economic wake has been unusually bifurcated compared to past crises. Since the pandemic requires social distancing, the recession and its aftermath have been concentrated disproportionately among “social and lower-earning” industries. This odd, if not unique, divergence in the economic fortunes of low and high-earning industries perhaps explains how overall real GDP, the unemployment rate, the housing industry, manufacturing activities, and other economic segments have managed to recover quickly and powerfully.