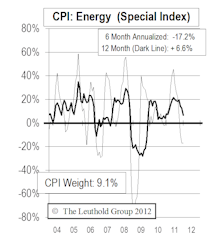

CPI Energy

Inflation-Keeping The Fed On Hold

Inflation is weak in July but the rebound in oil prices, the renewed weakness in the dollar and the strength in Chinese Yuan are all positive for inflation expectations in the near term. The disinflationary headwinds from outside of the U.S. are only getting stronger, not weaker. It’s hard to disagree with the market’s low rate hike expectations.

Reported Inflation Should Be Muted In 2012

For 2012, the reported CPI is expected to slip down to the +2% area (although items like lunches, transportation, parking and food may continue rising at close to a 10% rate).

Inflation Falls During/After Recessions, But Maybe Not This Time

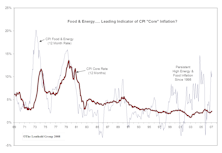

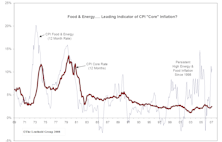

There is a strong linkage between higher Food and Energy costs and “Core” CPI, as these higher prices filter directly to the so-called “Core” CPI categories. If Food and Energy prices remain strong we could see a reacceleration in CPI inflation this fall.

Inflation Falls During/After Recessions

Longer term, we are concerned about the rising trend of food and energy inflation.

Fed Should Be Watching Food And Energy, Not “Core” Inflation

There is a strong linkage between higher Food and Energy costs and Core CPI.

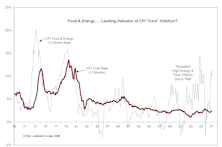

Food & Energy Inflation Has Been A Leading Indicator Of The “Core” CPI

Persistently high Food and Energy prices tend to drive the “Core” CPI inflation rate higher. These two subsets have now been in a rising pattern since the late nineties and cost pressures are forcing more and more manufacturers to raise prices.

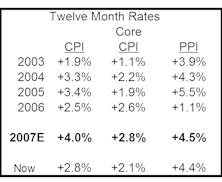

Still On Target For +4% CPI At Year End

We expect most broad inflation measures to accelerate over the remainder of the year, including CPI, Core CPI, CPU, PPI and GDP deflator.

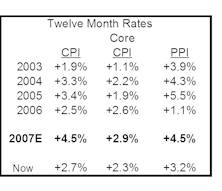

Inflation Outlook: Remains Worrisome

September CPI and PPI reports are likely to be much less favorable (more inflationary).

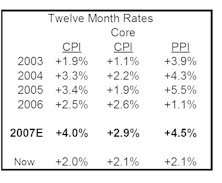

Inflation Outlook: Worrisome

We expect most broad inflation measures to accelerate over the remainder of the year.

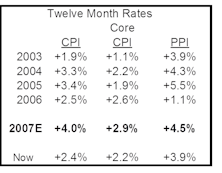

Inflation Outlook: Worrisome

We expect most broad inflation measures to accelerate over the remainder of the year, including: CPI, Core CPI, PPI and GDP deflator.

Inflation Watch

CPI twelve month rate will move higher in second half of year because comparisons will be against relatively low readings from 2004.

Answering Client Questions

Many of the questions in this month’s issue came from January client meetings in Texas.