Credit Ratings

The World Of Emerging Market Bonds

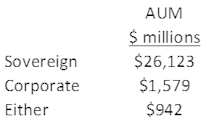

Investors looking to diversify away from the U.S. interest rate environment and/or the domestic business cycle may wish to consider Emerging Market bonds, an asset class with lower correlations to the U.S. Agg. Bond Index. EM bond investors can choose between several investment attributes to find the risk / return profile with which they are most comfortable. This study surveys the investment tradeoffs offered by each sub-category, as defined by ETFs focused on each particular asset class.

Research Preview: Emerging Market Bonds

The U.S. Aggregate Bond Index lost 3.8% in April, bringing its year-to-date return to an agonizing -9.5%. The realization that bonds can lose big money, combined with the outlook for stubbornly high inflation and continued rate increases, is nudging bond investors to consider a wider scope of alternatives.

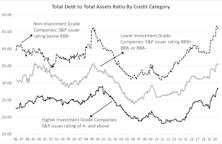

Corporate Debt Continues To Pile Up

Public companies are loading up on debt. Since we wrote about this topic over a year ago, a few metrics have reached, or are surpassing, peaks of 1999-2000. When the readings move to extreme levels, we recommend readers take precautions.

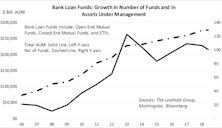

Bank Loan CEFs: Double Leverage Implies Higher Risk

In prior publications we’ve written about corporate leverage, which has risen to an alarming level, and we’re concerned that this could be a trigger for the next market downturn.

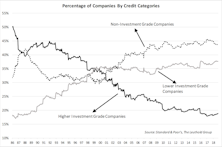

Think Halloween Is Behind Us? Beware, Zombie Alert!

“Zombie” companies are being kept alive by low interest rates and generous credit conditions, and the number of them, worldwide, has risen significantly over the past few years.