Cumulative Returns

Research Preview: Is Buy-Write The Right Buy?

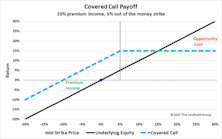

Many investors appreciate the benefit of covered-call strategies, but we wonder how many truly understand the opportunity costs of buy-write funds over time—or under differing conditions. On the surface, these approaches are simple, but they have complicated payoff patterns relative to stock and bond funds.

Factor Returns And A Basket Of EGGs

Equity factors are characteristics that have historically generated excess returns relative to the universe of stocks. However, in recent years factor returns have been underwhelming, causing investors to wonder if factors have become too popular, too crowded, or just plain obsolete. Then came the second quarter of 2022, when all six major factors outperformed the S&P 500, a feat only accomplished in four quarters over the last 27 years!

Tactical Junk

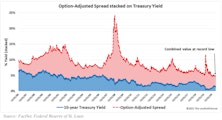

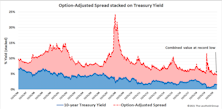

High yield bonds returned a robust 15.4% in the year ending June 30, extending a winning streak that produced a 56.4% cumulative return since the end of 2015. After a quick, severe drawdown at the height of the COVID-19 scare, junk bonds have experienced nearly ideal market conditions, heralding a return to trends that have been in place for several years. The post-pandemic move toward this record low has been a boon to high yield bond investors, but it has also created a significant risk of reversal. We believe most things in the financial markets are defined by cycles, with Treasury yields and credit spreads no exception. Tight readings for both rate series demand that we consider the possibility that a cyclical reversal could weigh on junk bond prices going forward.

Research Preview: High Yield’s Heyday

High yield corporate bonds returned over +15% for the twelve months ended June 30th, building on a strong five-year run that was interrupted by a short, but painful, drop at the onset of COVID-19. Chart 1 indicates that high yield bonds compound at a remarkably steady rate, with infrequent but severe drawdowns during times of financial stress.