Currency Risk

Tactical Tools For A Stronger Dollar

The 2022 bear market has been driven by collapsing valuation multiples, particularly for expensive growth stocks and unprofitable companies. Coming into the year, U.S. stocks stood as one of the most egregiously valued equity markets around the world, motivating investors to look elsewhere for more reasonably priced alternatives. Fortunately, international stock markets offered much better valuations that could serve as havens from the coming U.S. valuation collapse. Unfortunately, the strategy of seeking refuge in moderately priced foreign markets was foiled by an unusually strong U.S. dollar, leading us to take a closer look at how moves in the USD affect investment outcomes for domestic investors.

Research Preview: Returns In A Year Of Dollar Strength

The U.S. Dollar Index (DXY) has gained 16.2% YTD, its best performance in almost 40 years. However, a strong dollar is bad for those with international investments, as returns are slashed when translated back into dollars.

The World Of Emerging Market Bonds

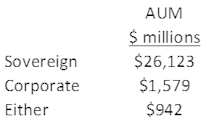

Investors looking to diversify away from the U.S. interest rate environment and/or the domestic business cycle may wish to consider Emerging Market bonds, an asset class with lower correlations to the U.S. Agg. Bond Index. EM bond investors can choose between several investment attributes to find the risk / return profile with which they are most comfortable. This study surveys the investment tradeoffs offered by each sub-category, as defined by ETFs focused on each particular asset class.

Research Preview: Emerging Market Bonds

The U.S. Aggregate Bond Index lost 3.8% in April, bringing its year-to-date return to an agonizing -9.5%. The realization that bonds can lose big money, combined with the outlook for stubbornly high inflation and continued rate increases, is nudging bond investors to consider a wider scope of alternatives.