Cyclical Stocks

Discretionary Durables: A Bubble In Fun

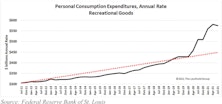

Extremely loose monetary and fiscal policies during the pandemic have created distortions and disequilibria throughout the economy. The most visible bubbles may be in financial markets, evidenced by the boundless valuations applied to visionary startups and the speculative fascination for digital assets of all types. This report examines a bubble of a different kind; not a financial bubble but rather a real-world bubble in “fun”. Producers of recreational goods are flourishing during the pandemic, posting massive sales gains and a tripling of net income, yet selling for miniscule valuations.

Research Preview: Discretionary Durables

While retail spending has boosted staples and durables alike, we believe that discretionary durables have been the prime beneficiary of changing lifestyles and spending patterns, with skyrocketing sales and inventory outages that may not reach equilibrium even in 2022.

Bonds & Cyclical Stocks “Decoupling”?

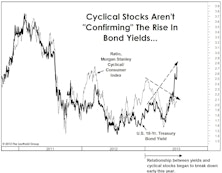

The relationship between U.S. Treasury bond yields and the relative performance of cyclical stocks versus their defensive consumer counterparts appears to be changing.

A Contrarian Call For The Second Half

With the notable exception of the Consumer Discretionary sector, cyclical stocks topped out globally on a relative basis in early 2011 (Chart 3). Throughout the last two and one half years, there have been repeated calls for industrial cyclicals—which were, of course, the leaders of the last cyclical bull market—to reassume stock market leadership.