Earnings Estimates

Excellent Back 9 For Q2 Reporting

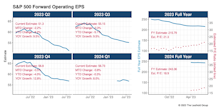

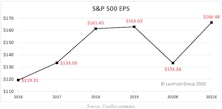

An outstanding second half for Q2-23 earnings pushed the S&P 500 bottom-up EPS estimate from $51.30 to $54.92. Amazon and Nvidia were the two largest contributors to the August surge. With the entire index nearly done reporting, our current EPS estimate will end 11% below its high watermark ($61.56).

Q2—The EPS Slide Resumes

Q2-23 reporting is about halfway complete for firms in the S&P 500. Bottom-up operating EPS estimates for Q2 are once again sliding lower as we wade farther into earnings season. This attrition is not uncommon but it is certainly a break from Q1 announcements, where EPS estimates rose 5% over the course of reporting. Q1’s action was a bullish talking point for many who touted the end of higher-than-normal erosion in forward EPS estimates over the past year. Since peaking in April 2022 at $61.56, Q2’s EPS estimate has shrunk nearly 17% (Chart 1).

Land Of The Rising Stock

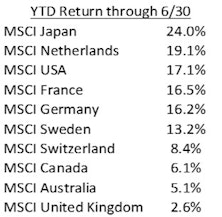

After years of wandering in the wilderness, Japanese stocks are leading the world’s developed markets higher in what has been a robust opening half of the year. The table shows Japan leading the world’s ten largest developed markets (as measured by the MSCI family of international indexes) with a 24% local currency return through June, easily outpacing the pack. Even as the MSCI USA index gained 17% by successfully “fighting the Fed” this year, Japan surged another 7% beyond that outstanding result. We were curious to understand the nature of Japan’s spectacular run in 2023, looking to identify the drivers of this strong and relatively quick jump higher.

Unraveling Q1’s Twists

Earnings Almanac is a new research product where we dive into quarterly reporting for the S&P 500. The report is released the first week of the last two months of the calendar quarter.

George Bailey Goes To Silicon Valley

One of the most vivid memories of the Great Depression is the sight of nervous depositors lined up outside a bank hoping to withdraw their meager savings before the bank failed. Like a rare tropical disease that was thought to be eradicated by modern medicine, the classic bank run reappeared this month in the form of Silicon Valley Bank. At the beginning of March, the market had no particular concerns about the potential for systemic bank failures, but SVB’s sudden demise has cast a pall over the entire industry.

Earnings Expectations: The Bear’s Other Shoe

To paraphrase that great market historian Leo Tolstoy, “each bear market is unhappy in its own way.” Recession, interest rates, valuation bubbles, inflation, war, credit cycles, oil prices, manias & panics: the tipping point that triggers each bear market is always different. However, bearish forces ultimately manifest themselves in just two ways; declining earnings and/or declining valuations. June’s Of Special Interest report detailed how the current bear market has been fueled entirely by collapsing valuations, with the largest P/E compressions occurring in companies with the highest starting valuations.

Margin Pressure Under The Surface?

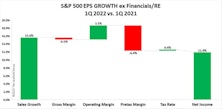

The spectacular economic rebound from the pandemic lockdown lifted corporate earnings to heights that are almost hard to fathom. That stupendous earnings run has been fueled by rising profit margins, which also reached record highs after the pandemic.

Research Preview: The Impact Of Falling Estimates

The 2022 bear market has been driven entirely by a collapse in P/E ratios. Last month, we noted that the other potential driver of market declines—falling earnings—had yet to raise its ugly head. Now we examine past episodes to consider how the stock market might react when the “other shoe” (EPS) drops.

2022 Earnings: Place Your Bets

It’s once again that time of year for what our founder deemed the great “thermal pollution.” Market pundits and prognosticators will divine, guess, and predict all that the market will bring in the new year.

The 2021 EPS Rocket Ship

If you want to see a rocket ship, there’s no need to crane your neck upwards to see the latest exploits of our billionaire space cowboys. Rather, look to our earnings glidepath chart and marvel at the contrails of the 2021 full year operating earnings for the S&P 500.

Looking Forward To 2021 Earnings

As we turn the page on 2020, a peek ahead to the S&P 500’s 2021 operating earnings is probably in order. You never know, earnings and valuations might be important again one day.

2021 Earnings: How Do We Get There?

According to FactSet estimates, S&P 500 earnings for 2020 are anticipated to come in near $133 per share, a drop of 18% from 2019 results. Given the widespread business disruptions and closures caused by the pandemic, one might have expected this year’s results to be much weaker.

Research Preview: 2021 Earnings Breakdown

Earnings estimates for 2021 are being projected above the records posted in 2018 and 2019. We ask the question, “How do we get there?” Here we present an introduction to this topic that we will examine at length and provide a full analysis in mid-October.

The Second Wave: No One Seems To Care!

While investors cheer the stock market on to challenge its all-time high, new COVID-19 cases are also making daily records in the U.S. The first wave of the pandemic helped to tank the S&P 500 by nearly 30% in the course of three weeks, while the second wave, now in development, has yet to deter the raging bulls.

Giving Up The Ghost

The approach of Halloween brings thoughts of jack-o-lanterns, scary movies, and buckets full of candy. The season also marks the time when investors finally give up the ghost on the optimistic, even wishful, earnings forecasts made early in the year.

Can Smart Analysts Generate Smart Beta?

One of the virtues of quantitative investing is that it relies on measurable data points that fit smoothly into mathematical models.

Can Smart Analysts Generate Smart Beta?

We assess the effectiveness of using Wall Street analyst opinions as factors in a quantitative stock selection model. Watch for the full report coming next week.

.jpg?fit=fillmax&w=222&bg=FFFFFF)

.jpg?fit=fillmax&w=222&bg=FFFFFF)

.jpg?fit=fillmax&w=222&bg=FFFFFF)