Earnings-Release

Earnings Are Back In Focus

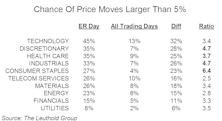

Earnings releases (ER) are normally accompanied by large stock-price movements, either to the upside or downside.

Here, we computed the percentage of companies that registered a large move in their stock price on their ER day in the trailing three-month window (500 basis points up OR down). In order to normalize for non ER-day volatility, we computed the percentage of all companies that registered a significant price move on any day during the same period. The difference between the two is shown in Chart 1.

Earnings’ Lost Relevance

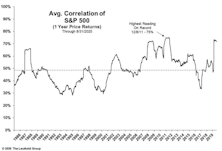

One characteristic of recent stock market action is extreme correlation. Chart 1 shows that during the sharp market decline following the COVID-19 arrival in the U.S. and the V-shaped upturn thereafter, the average correlation of S&P 500 constituents moved to near its highest level measured back to 1986.

Earnings Releases Cause Surge In Price Volatility

Three years ago, we did a series of studies looking at price reactions to corporate earnings releases (ER) and we found that, since 2007, price movement has become more dramatic on ER days.

Calendar Effect On Earnings-Release Day Price Movement

Earnings season is not only important for fundamental investors, it can be equally so for quant managers. For quants that incorporate fundamental data, like us, historical trends and changes in consensus estimates may weigh heavily on model output.

Earnings-Release Price Movement Among Sectors/Industries

Earnings season is not only important for fundamental investors, it can be equally so for quant managers. For quants that incorporate fundamental data, like us, historical trends and changes in consensus estimates may weigh heavily on model output.

Guidance & Price Movement On Earnings-Release Day

We study the effect of company guidance on ER-day price volatility. Do companies issuing more frequent and detailed guidance help to prevent big surprises on ER day?

Puzzling Trend Of Earnings Release Price Impact

The ER price impact has shifted higher post 2008-2009 financial crisis, and the movement has been more pronounced in the Small Cap universe. A look at analyst coverage and accuracy of estimates.

.jpg?fit=fillmax&w=222&bg=FFFFFF)