Earnings Yield

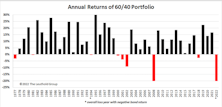

The 60/40’s Annus Horribilis

The balanced portfolio strategy of allocating 60% to equities and 40% to fixed income generated a highly satisfactory 7.9% annualized return over the last 30 years. Despite the excellent returns earned by investors following this strategic model, the past couple of years have seen a parade of articles with headlines such as “Is the 60/40 Portfolio Obsolete?” and “Is the 60/40 Dead?” Given the central importance of this moderate allocation strategy to investment industry practices, we felt a closer look at the 60/40 portfolio was in order.

Research Preview: The 60/40 Skeptics Were Right

The 60/40 strategy is having a terrible year, and its failure to protect investors in the bear market prompted us to take a look at the history and theory of the 60/40 guideline. We offer an early preview of the study, with a focus on 2022’s abysmal year-to-date returns.

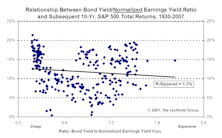

Stock Values: Absolutely, Relatively

The severity of the market’s current overvaluation depends on one’s historical vantage point.

Of Special Interest: Valuing The Stock Market - Do Interest Rates Matter?

Models based on so-called relative valuations have a poor track record in practice, having misled investors at several historic inflection points. Interest rates have virtually no impact on stock market valuations, but they may have transitory effects on stocks in the short term.

Graham Model Revisited

Last month, using Ben Graham's model, we found the U.S. market to be undervalued for the first time in about 50 years. Unfortunately, the values have become even more compelling over the past five weeks.

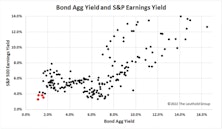

Interest Rates And Stock Valuations: A Broken Linkage?

A look at the relationship between bond and stock yields as justification for today’s expectations of a continued bull market and for the current LBO craze. No evidence that Fed-type valuation models help forecast future market returns.

High P/E Stocks: Becoming A Safe Place To Hide?

Value continues to have leadership position over Growth among Large Cap stocks. Mid Caps also shifting to favor Value, but Growth still leading in the Small Cap tier.

The Historical Relationship of Earnings Yields to Bond Yields…. Another Installment

In the August issue, we examined the historical relationship of bond yields and common stock earnings yields, looking at it in terms of a ratio. In this issue, we make the same comparison in terms of a basis point differential.