Equity Funds

2013’s Fund Flow Trends Have Room To Run

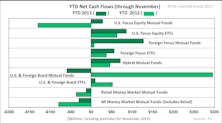

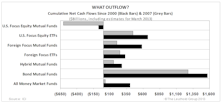

Year-to-date, equity funds are cash on par with those of the 2000 tech bubble, while bond mutual funds are experiencing net cash outflows for the first time in a decade.

Fund Flows Still Not Quite As They Appear

In this report we take an in-depth look at the evolution of the industry, particularly the U.S. mutual fund industry, to help understand how some fund flow trends are more of an indication of evolving investor preferences instead of an indication of retail investor sentiment toward a particular asset class.

Estimating The Upside: Yes, We Still See Some

Despite our still (cautiously) bullish outlook, historical P/E levels which once provided support to the stock market are expected to now offer resistance as the market moves higher.

An Open (Yet Purely Theoretical) Letter To Individual Investors

When you are all doing the same thing at the same time, it’s usually a good time to question if the investment makes sense anymore.

Tracking Cash...Who Has It, And Who Doesn’t

Still a mountain of cash available (MZM data), which could find its way into the stock market. Don’t confuse scarcity of buyers with scarcity of liquidity.

Foreign Investors Bullish On U.S. Stocks...The New Contrarian Sell Signal

Because Main Street investors have ignored the U.S. stock market during the recent bull market, they are not a useful contrarian gauge. However, in looking at foreigners investing in the U.S. stock market, we may have identified a new source of contrary behavior.

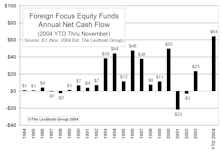

Offshoring The Next Bubble?

Main Street’s rush into international stock funds could be foreshadowing tougher times ahead for foreign markets.

The Market Impact Of Today's Net Redemptions

The important role of cash levels in today’s mutual funds.

January Mutual Fund Flows

Net inflows into U.S. focus equity funds were somewhat ahead of last year’s pace by the end of January. Estimated net inflows of $18 billion compares to last January’s $16.1 billion.

January Mutual Fund Flows

Net inflows into equity funds lagged somewhat behind last January. We estimate U.S. focus equity funds experienced still strong net inflows of $17 billion, but foreign focus net inflows may have been less than $1 billion (net redemptions in the first few weeks).

Where Will The January-February Liquidity Flood Go?

Regardless of conflicting trends being reported in December by AMG and Trim Tabs, our studies conclude that December net inflows into U.S. focus funds (not foreign funds) exceeded December 1996.

Are Today's Mutual Fund Investors Different?

Over and over we hear and read that today’s mutual fund investors are different. They are truly long term investors saving for retirement.

View From The North Country

In December 1989, a survey of program trading opinions was taken among the members of the National Organization of Investment Professionals.