Factor Cyclicality

Factor Returns And A Basket Of EGGs

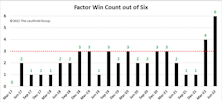

Equity factors are characteristics that have historically generated excess returns relative to the universe of stocks. However, in recent years factor returns have been underwhelming, causing investors to wonder if factors have become too popular, too crowded, or just plain obsolete. Then came the second quarter of 2022, when all six major factors outperformed the S&P 500, a feat only accomplished in four quarters over the last 27 years!

Research Preview: Factor Cyclicality

In Q2, all six major style factors outperformed the market. Those results are especially remarkable considering that factor excess returns the past few years have been underwhelming to the point that some investors began to wonder if they still work.

Tis The Season For Factor Tilting

Factor investing has gained wide popularity in recent years, enabled by a proliferation of smart-beta ETFs coming to market, which opened new opportunities for tactical investors. In 2018, we launched our Factor Tilt ETF strategy, and here we discuss how we’re now enhancing it by adding Seasonal Cyclicality to our analytical toolbox for evaluating factor conditions.