Factor Metrics

Factor Tilt Regime—October 2023

The dominating and overwhelming gains by the Magnificent Seven have made it nearly impossible for most traditional equity factors to excel. Only two styles have managed to surpass the S&P 500’s YTD return: Growth and Quality—and both have healthy exposures to the Magnificent Seven.

Factor Tilt Update—June 2023

This Leuthold Refresh updates our Factor Tilt analysis, an ongoing process to evaluate the attractiveness of commonly accepted investment styles. Factors are investment characteristics that have historically produced excess risk-adjusted returns, but relative results fluctuate over time.

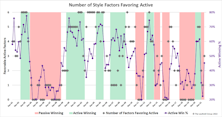

The Active/Passive Performance Cycle Second Quarter 2022 Update

The performance derby between actively-managed portfolios and passively-managed index funds is a topic of ongoing interest for Leuthold clients and the investment community at large. Therefore, we are providing an update to all charts and tables of our Active/Passive performance analyses.

Leuthold Factor Tilt Update

Factor analysis is a point of emphasis in Leuthold’s tactical research activities, and this note summarizes our Factor Tilt outlook going into the fourth quarter. Factors are return drivers such as Value, Momentum, and Quality, and research has found that factor results vary over time—but that does not mean they are random.

.jpg?fit=fillmax&w=222&bg=FFFFFF)