Fed Model

Meanwhile, In “Relative World”...

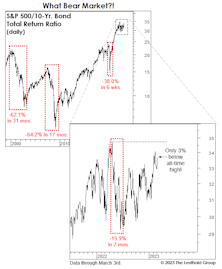

A large swath of the institutional asset-allocation world is engaged in the sometimes dangerous, binary game of “stocks versus bonds.” Although the 2022 bond debacle caused relatively mild damage to a massively overweight equity position, the bear markets of 2000-2002 and 2007-2009 produced losses for stocks versus bonds that exceeded 60%.

Time To Retire The Fed Model?

We’ve heard no references lately to the famous “Fed Model” for stock market valuation. We think we know why: The model’s usual proponents probably don’t like its current verdict—which is that stocks are far more expensive than at the early January market peak.

Stock Values: Absolutely, Relatively

The severity of the market’s current overvaluation depends on one’s historical vantage point.

Interest Rates And Stock Valuations: A Broken Linkage?

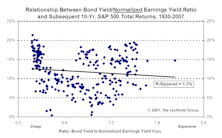

A look at the relationship between bond and stock yields as justification for today’s expectations of a continued bull market and for the current LBO craze. No evidence that Fed-type valuation models help forecast future market returns.

View From The North Country

Valuation tools comparing stock earnings yields to bond yields (i.e. the Fed Valuation Model) are worthless. History shows they don’t perform very well at all.

Irrational Exuberance Then & Now

Many investors have come to realize just how overvalued the stock market became in the late 1990s. Alan Greenspan may have been early with his comment about “irrational exuberance” in late 1996, but in hindsight his warning was warranted.

.jpg?fit=fillmax&w=222&bg=FFFFFF)