Forward Annualized Returns

What If The Valuation Message Turns Out To Be Really Wrong?

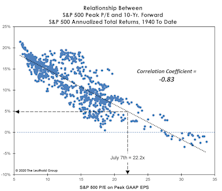

Today’s Peak P/E ratio implies the S&P 500’s ten-year-forward annualized total return will be in the range of -3%. If this P/E ratio turns out to be as deceptively pessimistic as it was at its worst point in history, the S&P 500 could produce an annualized nominal total return of about +5% over the next decade.

Low Single Digits?

We encourage diversity of thought in our shop, but even pessimists among our ranks have a hard time making the case for a ten-year negative return for U.S. stocks, which was recently predicted by the founder of a large hedge fund.

“Too Smooth” Of A Ride?

While investors in Value, Small Caps, and especially foreign stocks might beg to disagree, a key MTI technical measure suggests this decade’s stock-market ride has been almost entirely “pain free.”

Assessing The Cyclical Risks

With all the excitement over the Fed’s shift in rhetoric and the excellent subsequent market action, there’s a danger of losing sight of the broader cyclical backdrop for U.S. stocks. Remember, the economy is still operating beyond government estimates of its full-employment potential, and it’s not as if the Fed has actually eased policy—as it did successfully at a similar late-cycle juncture in the fall of 1998 and (ultimately unsuccessfully) in the summer of 2007.