Forward P/E Ratio

In The “Eye” Of The Beholder

Stocks could trade higher in the next few months as CPI numbers enjoy easy year-to-year comparisons, prompting a more soothing tone in daily Fed-speak. Then again, the lagged impact of the last year’s rate hikes and balance-sheet shrinkage has yet to materialize, meaning we’re likely in the eye of the storm.

Tactical Tools For A Stronger Dollar

The 2022 bear market has been driven by collapsing valuation multiples, particularly for expensive growth stocks and unprofitable companies. Coming into the year, U.S. stocks stood as one of the most egregiously valued equity markets around the world, motivating investors to look elsewhere for more reasonably priced alternatives. Fortunately, international stock markets offered much better valuations that could serve as havens from the coming U.S. valuation collapse. Unfortunately, the strategy of seeking refuge in moderately priced foreign markets was foiled by an unusually strong U.S. dollar, leading us to take a closer look at how moves in the USD affect investment outcomes for domestic investors.

“PSsss”

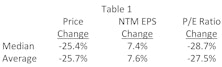

The most brutal bear markets occur when falling earnings are accompanied by shrinking valuations, producing a compound negative effect on stock prices. Investors in 2022 have (so far) avoided this double-whammy in that valuations have taken a hit, but EPS estimates are holding strong. We are intrigued by the notion that 2022’s bear market has, to date, been all about valuation compression rather than earnings weakness. Investors are coping with the problems of the day by letting the air out of bubbly valuations, and this report takes a closer look at the valuation squeeze underlying the current selloff.

Research Preview: P/E Multiple Compression In 2022

Stock market corrections are the result of falling valuations and/or falling earnings, and when both conditions appear together, investors are in for a rough ride. Thus far, the 2022 selloff has been confined to compressing P/E ratios, and we launched a research project to take a closer look at shrinking stock valuations in this market downdraft.

Young Bull, Old Threat

By our count, the current bull market is the 13th of the postwar period. The 88% gain achieved by the S&P 500 in less than 14 months already places this bull sixth in terms of cumulative gains. We considered it a hindrance that this bull commenced from higher valuation levels than any other in history. Instead, they seem to have provided a head-start.