Group Report

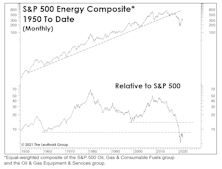

Energy Attains #1 Ranking For First Time Since 2009

The Energy sector has improved across a variety of factor subsets, with particularly large jumps in growth and macro/economic categories. For investors weighing investment ideas in the Energy space, we highlight the three Attractive groups for consideration.

Financials Strength Endures At Top Of GS Scores

Financials has occupied the #1 overall ranking for all of 2021, thus far, but its absolute score has increased throughout the year due to well-rounded strength across the factor spectrum, reaching levels not seen in more than twenty years.

Energy Makes Its Move

After years of languishing in the rock bottom of Group Selection Scores and sector rankings, Energy exploded higher this month, jumping from 10th lowest (out of eleven broad sectors) to 3rd highest in our composite rankings.

Digging Into Materials

If there are shortages, bottlenecks, and commodity inflation everywhere, why is the rating for the Materials sector so uninspiring? Although valuations are compelling for Materials groups, the overall decline in the rankings can be traced to EPS revisions and macro influences, like the U.S. dollar and low rates.

Automotive Retail: Attractive Amidst Industry Recovery

Automotive Retail currently ranks Attractive per our Group Selection Scores. This group offers a range of exposure to a bumpy—but recovering—U.S.-auto industry made up of car dealerships and auto parts & service retailers.

Financials Sector Ranks #1 In GS Scores

Impressive strength across the factor spectrum implies that the recent pop in the long-time beaten-down Financials sector should have more room to run. We highlight five attractively-rated Financials groups for investment ideas beyond the popular big-bank-concentrated Financial sector ETFs.

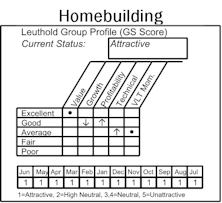

Housing-Related Groups Top The Rankings

Housing-related groups have catapulted to the very top of our rankings. Several of these are among the top-ten performers of our 120-group universe. Despite the strong returns for these industries, our GS Scores indicate that this theme has even more room to run.

Homebuilding Holds Steady At The Top Of GS Scores

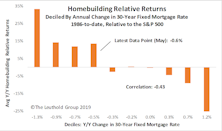

As new home sales skyrocket alongside plummeting mortgage rates, we revisit the historical relationship between Homebuilding stock returns and industry-specific factors that impact housing affordability and homebuilders’ bottom lines.

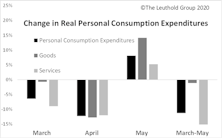

Examining The “Reopening Economy” Theme At The Group Level

We examine a variety of industry groups with noteworthy relative price action on both “reopening” and “closed economy” days. Our objective is to shed more light on the industry groups that are consistently moving together on these days.

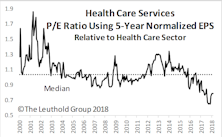

“Reliable” Health Care And The Presidential Election

Health Care has been resilient this year, but will that continue in the run-up to the presidential election? We look at the performance of the Attractively-ranked industry groups and how they have historically performed leading up to an election and post-election.

Housing Groups Heat Up

A major driver of the division in recent performance among retail groups has been the burgeoning “nesting” theme. Stuck at home, consumers are directing their dollars toward indoor and outdoor home upgrades. A related theme has now established itself in the upper rankings of our group work—Housing.

Retail’s Winners And Losers Of The Pandemic

Following the market bottom, the rebound across retail industries has been robust, but a divide has emerged. Consumers’ needs and behaviors have dramatically shifted as former lifestyles were uprooted. This swift change in economics has resulted in clearly-defined sets of winners and losers among retail industries.

Pockets Of Strength Among Discretionary Industries

A brief overview of two (very different) Attractively-rated Discretionary groups that are longstanding SI portfolio holdings that have managed to maintain their “Attractiveness” throughout the tumult.

S&P 500 Sector Leaders Since Market Top

Since the market peak on February 19th the S&P 500 Health Care sector is down only 1.1%. Among the S&P 500 sector indexes, Health Care and Consumer Discretionary are the performance leaders.

Robust Health Care Leads Since Market Peak

Health Care has been the best performing sector following mid-February’s market peak. Its robust relative performance during this bear market isn’t terribly surprising given the sector’s defensive qualities, but it has impressively outpaced other safe haven areas.

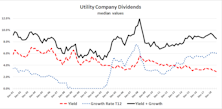

Group Ideas For Tumultuous Times

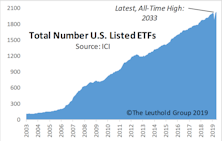

The economic outlook has turned increasingly cautionary, investors are on edge, and the search for yield persists. Because the typical defensive/high-yielding plays are generally both expensive and unappealing in our group work, we highlight several less conventional groups that may be poised to outperform.

Seeing Construction Materials’ True Colors

Construction Materials moved to an Attractive rating, fueled by growth and price momentum. Surprisingly, digging into the numbers revealed it to have lower beta dynamics. Based on this, we examined the cyclical nature of the group to better understand the impact it may have on overall portfolio cyclicality.

Utilities' Valuation Millstone

Even though the S&P 500 roared ahead by nearly 50% over the last three years, the traditionally low beta slow-growth Utilities sector outperformed during that powerful upswing. Nevertheless, today Utilities seldom look attractive by active managers and calls to overweight the sector are scarce.

Industry Groups Topping The Charts In 2019

The groups we examine here are particularly interesting because they are a diversified mix across sectors with varying macro-factor relationships and risk profiles. They have scored well for a long period of time and have been long-term positions in our SI portfolio.

Fresh Look At The Education Services Group

We take a look at the group’s constituent transformation, its robust GS Score, political/regulatory tailwinds, and its ability to withstand and hold up well during market downturns and recessions.

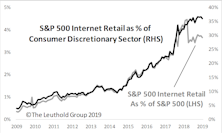

Internet Retail: Beyond Amazon

Amazon has become synonymous with the Internet Retail industry, however, this group is comprised of a diverse mix of companies ranging across the market spectrum, and strength is being exhibited throughout the group.

Financials Strengthen Among GS Scores; Specialized Finance Purchased

The Financials’ Group Selection (GS) Score sector-composite rating has incrementally improved over the past five months, rising to rank #2 out of 11 sectors in late June.

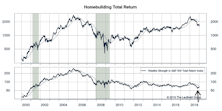

Homebuilding Stocks Take Flight

Homebuilding rose to rank #1 among our universe in our latest monthly Group Selection (GS) Scores. The industry has staged an impressive turnaround, beginning in October 2018, with strong returns outpacing the S&P 500 by more than 2.5x YTD.

Information Technology Sector Now Highest Rated

For the first time since late 2017, Information Technology moved into the top-rated spot. This sector has historically produced especially strong results during periods after which it took over the #1 seat.

Movies & Entertainment & Broadcasting Revisited

Performance has been robust for this group, rising on a relative strength basis since the end of 2017. Its diverse mix of constituents equates to a group that, overall, is middle-of-road in terms of beta and volatility relative to other industries. These dynamics have contributed to its solid relative returns across diverging market environments of late.

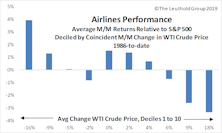

Airlines Travel To Attractive In The GS Scores

We look at our domestic Airlines’ GS Score and examine the historical relationship between oil prices and Airline stocks. Additionally, we explore several other data sets to determine where the industry’s supply/demand picture stands heading into 2019.

Housing Affordability & Homebuilding Stocks

The Homebuilding stocks represent another Consumer Discretionary group ranking Attractive via our GS Scores; we have held the Homebuilding group for the last year and a half. Homebuilders is an extremely rate-conscious industry group given mortgage rates’ impact on housing affordability (and thus, demand).

Restaurants Group Dishes Up Defense

The Restaurants industry is another Consumer Discretionary group ranking Attractive via our GS Scores; we purchased it in the Select Industries (SI) portfolio in November. This group has exhibited defensive qualities of late.

Brick & Mortar Retail Evades October Sell-Off

Although Discretionary stocks broadly underperformed during October’s market decline, prominent amongst the very top industry group performers was a rather unexpected genre of industries—brick & mortar retail. Not only did this cohort hold up during October’s tumult, but many of the underlying stocks have been posting strong returns all year.

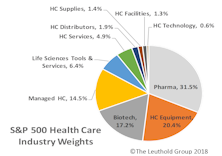

Defensive Health Care Outpaces The Market

Recently, Health Care stocks have been making headlines as the sector rallies to new all-time highs. However, when we look at the sector via Leuthold’s proprietarily-built industry group composition—which has a more realistic market-cap weighting approach—the Health Care sector has been outperforming since the end of 2017, and YTD it is the #1 performing sector in our work.

A Phoenix Rises: The New Communication Services Sector

Herein we include an executive summary previewing our forthcoming, in-depth special report on September’s GICS sector changes. The full report, “A Prehistory of the Communication Services Sector” will be distributed soon.

Attractively-Rated “Movies & Entertainment & Broadcasting” Group

Movies & Entertainment & Broadcasting’s Group Selection (GS) Score has been steadily improving of late; it rose to High Neutral in March and pushed up to Attractive two months ago. Currently a member of the Consumer Discretionary sector, this is a less-correlated option to the many retail industries also currently ranking strongly among the Discretionary components.

Highlighted Attractive Groups

Consumer Discretionary is the highest-rated sector for the fifth consecutive month; Info Tech and Financials have been trading places between #2 and #3 for five months. Coming in last (again) is Utilities.

Health Care Facilities Purchased In Select Industries

YTD, out of the 110 industries, HC Facilities is the fourth best performing group

Highlighted Attractive Groups

Air Freight & Logistics is now Attractive for the first time in two years; Managed Health Care has scored in the top tier dating back to 2009; Trading Companies/Distributors provides an option with oil exposure at a time when the GS Scores remain decidedly anti-oil overall.

Discretionary Reigns: Hotels & Leisure Revisited

The Consumer Discretionary index has also managed to outperform the S&P 500 by about 100 bps since the market’s January 26th peak, and in late March it was just a hair away from surpassing its previous relative strength performance high recorded in late 2015.

Highted Attractive Groups

Department Stores have rallied the last four months; Health Care Distributors is one of the cheapest groups we track; Paper & Forest Products is the only Materials group in the Attractive range of the GS Scores.

Health Care Services Purchased In Select Industries

Our Group Selection (GS) Scores ranked Health Care as one of the top two sectors for a majority of 2011-2015; sector relative strength soared over that period.

Highlighted Attractive Groups

Airlines rebounded after a brief dip to High Neutral; Health Care Distributors is scoring well across the board (other than Technical factors); Specialty Stores is cheap due to the changing retail landscape.

GS Scores: Industrial Metals Stocks Heating Up

While the Materials sector overall still isn’t looking stellar based on our work, we think with the Metals theme heating up, it’s a trend worth watching.