Homebuilding

Rankings At The Top Offer Diversified Mix

Energy remains the top-rated sector, but Information Technology, Communication Services, and Financials follow closely behind. These offer a diverse mix of commodity, growth, and cyclical options.

Housing-Related Groups Top The Rankings

Housing-related groups have catapulted to the very top of our rankings. Several of these are among the top-ten performers of our 120-group universe. Despite the strong returns for these industries, our GS Scores indicate that this theme has even more room to run.

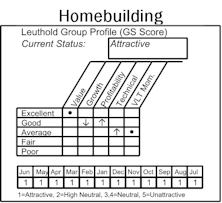

Homebuilding Holds Steady At The Top Of GS Scores

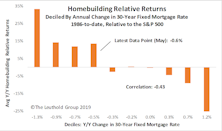

As new home sales skyrocket alongside plummeting mortgage rates, we revisit the historical relationship between Homebuilding stock returns and industry-specific factors that impact housing affordability and homebuilders’ bottom lines.

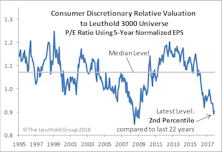

Pockets Of Strength Among Discretionary Industries

A brief overview of two (very different) Attractively-rated Discretionary groups that are longstanding SI portfolio holdings that have managed to maintain their “Attractiveness” throughout the tumult.

Group Ideas For Tumultuous Times

The economic outlook has turned increasingly cautionary, investors are on edge, and the search for yield persists. Because the typical defensive/high-yielding plays are generally both expensive and unappealing in our group work, we highlight several less conventional groups that may be poised to outperform.

Industry Groups Topping The Charts In 2019

The groups we examine here are particularly interesting because they are a diversified mix across sectors with varying macro-factor relationships and risk profiles. They have scored well for a long period of time and have been long-term positions in our SI portfolio.

Homebuilding Stocks Take Flight

Homebuilding rose to rank #1 among our universe in our latest monthly Group Selection (GS) Scores. The industry has staged an impressive turnaround, beginning in October 2018, with strong returns outpacing the S&P 500 by more than 2.5x YTD.

Consumer Discretionary Back On Top

Of the 110 industries in our framework, the top seven are all Consumer Discretionary.

Highlighted Attractive Groups

Home Entertainment Software, Managed Health Care, and Specialized Consumer Services are among the month’s intriguing opportunities based on the current Group Selection (GS) Scores.

Highlighted Attractive Groups

Automobile Manufacturers, Health Care Distributors, and Homebuilding appear to be solid opportunities based on the current Group Selection Scores.

Housing Theme Framed Among Top GS Scores

Attractive-rated groups include Building Products, Homebuilding, and Household Durables—these three groups possess similar industry drivers and thus exhibit highly-correlated stock returns.

Highlighted Attractive Groups

We examine the factor category strength behind Food Retail & Distributors, Homebuilding, and Water Utilities.

Homebuilding Group Downgraded And Sold

What initially looked promising fell apart fairly quickly

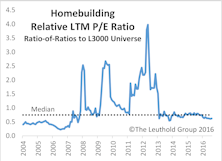

Homebuilding, More Than Just Curb Appeal?

While this Consumer Discretionary group has not experienced six-plus-years of market outperformance, we think it may be poised for a late-game bounce. An overall lack of housing options may be just what this industry needs to give it a long-awaited boost.

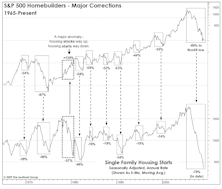

Housing: Curb Your Enthusiasm

Despite record low mortgage rates and pressure to re-loosen down payment and lending requirements, single family housing starts have yet to recover to levels consistent with even the average recession trough.

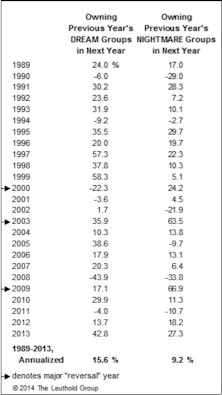

The Dreams & Nightmares Of 2013

For 25 years we’ve tracked hypothetical industry group portfolios comprised of the previous year’s “Dreams” (20 best performers) and “Nightmares” (20 worst performers).

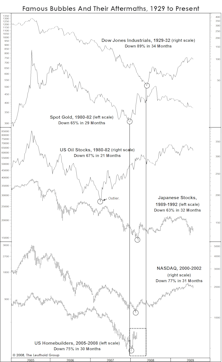

Housing: Just Like The Bubbles Before It

Sectors that become the object of obsession during one economic cycle tend to remain cyclically depressed in the following one.

Handicapping The High In Housing

Today it seems taken for granted that the great housing meltdown of 2006-2010 was sufficient to purge the last decade’s excesses, and that housing can now be relied upon as one of the drivers of a slow but elongated U.S. economic expansion.

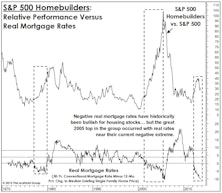

Rates Too High For A Housing Rebound?

Are mortgage rates still too high for a rebound when looking at real mortgage rates?

What Keeps Us Up At Night

We consider it incredible that most of the leading economic indicators have staged such traditional V-shaped rebounds with virtually no boost from the housing sector.

A Ray Of Hope For Housing

If the November lows in the Homebuilders holds, based on the leading relationship between stocks and starts, an upturn in housing starts (not the broader economy) should be imminent.

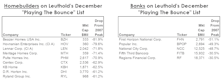

A Discount Shopping Guide To Banks And Homebuilders

With a heavily promotional holiday shopping season underway, we feel compelled to join the fray by looking at the big markdowns in U.S. homebuilding and bank stocks.

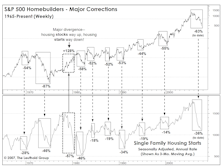

Homebuilders.....Watching The “Window”

Not all gloom and doom this month...Homebuilders approaching window where past busted bubbles have bounced.

Housing: Still Too Early To Invest (Or To Build)

It’s still too early, but at some point in the next 6 to 18 months, going long the homebuilders will probably become the single most contrarian—and potentially highly profitable—thing to do. But before that happens, we expect to see more blood in the streets.

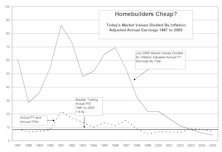

The Homebuilding Group – Value Play Or Value Trap?

Everybody sure hates the Homebuilders. However, contrarians should take note of this month’s analysis of earnings prospects, insider selling/buying, and the outlook for future housing starts. Now is not the time to be bottom fishing here.

Answering Client Questions

Many of the questions in this month’s issue came from November’s client meetings in San Francisco.

Time To Look At Shelter Stocks?

Several months ago Pulte Homes was added to our model as a "special situation" anticipating the possibility of a future broader move into the shelter area.