Index Rebalancing

Masquerade Party

Style investors recently witnessed a rare event when, on February 13th, the P/E ratio of the S&P 500 Growth Index fell below that of the S&P 500 Value Index. At first glance, it is tempting to attribute this valuation flip-flop to the 2022 bear market, which saw Value outperform Growth by a whopping 24.2%. However, the bear-induced collapse of Growth stock prices in 2022 only served to return the P/E spread to a level just below its historical median of 5.1, meaning that the final move toward parity was caused by a force outside the market itself. That “something else” was the S&P 500 style reconstitution that occurs annually on the third Friday of December.

Research Preview: I Own What?!

S&P rebalanced its style indexes in December, and the shuffle caused substantial turnover. The Value index now includes a sizeable swath of mega-cap tech companies, and this changing membership significantly affects the relative valuation metrics that defined those styles.

Index Rebalance Effect—A Disappearing Anomaly?

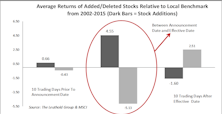

In the past we’ve made the observation that adding/deleting stocks to/from a popular index can have a profound impact on the target stocks’ short-term trading volume and performance.