Indexes

Mixed Messages From VLT

While VLT for the S&P 500 continued to trend lower in November, the DJIA calculation edged higher and triggered a new BUY signal. The message could soon get more confusing: A BUY signal for the Russell 2000 would be triggered if that index closes December above 1,813, while the S&P 500 and NASDAQ would have to climb more than 11% and 15%, respectively, to trigger a VLT BUY.

View From The North Country

“What? You’re buying MORE Junk Bonds?!” “Regulation FD” could ultimately improve the depth and quality of analyst research, turning the focus back to more relevant, longer term outlooks. “Sell Side” Stock Research: The reasons why we no longer use it.

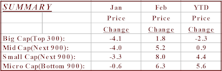

Performance By Cap Tiers...Our New Measures

S&P 500, S&P 400, and Russell 2000 may not always present accurate readings of Big cap, Mid cap and Small cap performance, respectively.

View From The North Country

Chasing the tale of past performance…The large cap indexing stampede. It’s not too late to get invested in emerging market funds. Also “Richer than your wildest dreams”…The advertising pitch of online trading firms. Who is protecting the public from this?

Indexing Update

Index fund net inflows remained low in September at about $1.1 billion (estimated). This is almost flat compared to the $1.2 billion in August.

August Fund Flows

In August, there were two weeks of net outflows from U.S. focus equity funds, the most recent was so small it hardly shows up on the chart.

Index Fund Update

Index fund assets approaching $78 billion, 6% of U.S. focus fund assets... Year to date, index fund flows now account for about 14% of domestic total.

Current Outlook

It’s “Never Never Land”...stock market now above all past valuation extremes. Ultimately, a big bear market is out there, but shorter term the market may go higher.

February Mutual Fund Flows

Revised January 1997 U.S. equity mutual fund flows of $23.4 billion, setting an all-time record. February’s estimate of $20 billion brings YTD U.S. focus fund flows to $43 billion, well ahead of last year’s record pace.

Big Cap Market

Big cap bias in market may be driven by increased enthusiasm for index funds. S&P becoming difficult to beat, P/E ratios of Royal Blue tiers compressing.

Worth Noting

Steve's thoughts on borrowing to buy mutual funds, indexing and an eerie post-Halloween graphic.

View from the North Country

Welcome Scott Archer.... More Bank Troubles and Write-Offs.... U.S. Banks Played Key Role in Oil Bath, Real Estate Debacle, Third World Loans and Busted LBO’s.... America As The “Center” Of the World Economic Universe.... Australia/New Zealand Update

1987 Starts With A Bang

Even after the excitement of early January, it still looks like a major cyclical bull market top is in progress.

Circles and Cycles: The Current Index Fund Boom

Herein, we examine the new surge of indexing on the part of pension funds, explaining why we think it may be just the wrong time to be abandoning active investment management. While ultimately most equity managers can be expected to underperform the averages, the timing of the current rush to indexing may be all wrong. Shades of the late 1970’s!

View from the North Country

South African Divestiture: The campaign against investing in companies doing business with South Africa is rapidly building momentum…TV Tulips: Recent prices paid for commercial TV properties may be tulip bulb prices… Will It Take a Crisis?: I am just about convinced that only a crisis can bring meaningful fiscal reform.