Insider Block Sales

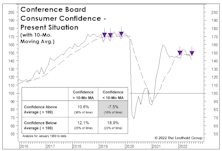

Confidence Cracking?

The theory of “contrary opinion” is important to market analysis, but so is an understanding of its limitations. When investor-sentiment surveys dipped sharply in late January, we warned that the declines (which are usually signals to “buy”) might instead mark the beginning of an important trend change.

Watching The “Smart Money”

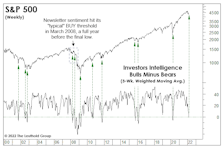

Of the prevailing bullish arguments, the one that strikes us as the weakest is that there’s “too much pessimism.” Much like in 2000, some pundits disingenuously made that claim before the market rolled over. But at this point, with the market now down big and economic numbers suddenly wobbly, the last thing any bull should want is too much pessimism.

Sentiment: Why The Long Faces?

Those who want validation to buy aggressively with the market down 10% can reference two historically reliable, intermediate-term sentiment measures with fresh BUY signals—and there’s a third one that’s also very close to triggering a BUY. The problem is that boundaries defining extreme psychology change over time—with a key inflection occurring as the market transitions from bull to bear.