Internet Retail

Retail’s Winners And Losers Of The Pandemic

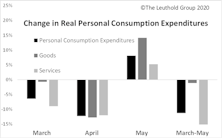

Following the market bottom, the rebound across retail industries has been robust, but a divide has emerged. Consumers’ needs and behaviors have dramatically shifted as former lifestyles were uprooted. This swift change in economics has resulted in clearly-defined sets of winners and losers among retail industries.

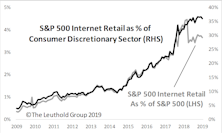

Internet Retail: Beyond Amazon

Amazon has become synonymous with the Internet Retail industry, however, this group is comprised of a diverse mix of companies ranging across the market spectrum, and strength is being exhibited throughout the group.

Water Utilities Sink

Internet Retail and Department Stores are this week's best groups. Electric Utilities and Water Utilities are this week's worst groups.

Airlines Crash

Internet Retail and Reinsurance are this week's best groups. Semiconductors and Airlines are this week's worst groups.

Gas Utilities Stink

Internet Retail and Department Stores are this week's best groups. Real State Investment Trusts and Gas Utilities are this week's worst groups.

Internet Retail Leads This Week

Internet Retail & Precious Metals were this week’s best groups and Oil & Gas Refining & Marketing was this week's worst group.

Internet Retail Claws Some Back

Internet Retail and Biotech lead the latest week while Home Entertainment Software and Live and Health Insurance lagged.

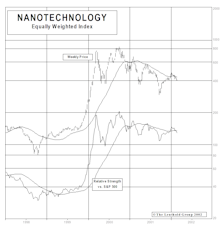

Fad Groups

Looking at performance swings of Nanotechnology, Internet Software & Services, and Internet Reatil.

Fad Groups

Some groups tend to move in and out of favor in a hurry. We review the dramatic performance swings of our recently created Security Companies and BioDefense groups along with Energy Technology.

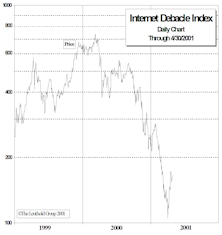

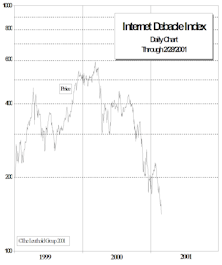

Internet Debacle Index

If we get another performance month like April, we may again have to re-christen this as The Internet Opportunity Index.

Internet Debacle Index

Last month, we changed the name of this group. After a bounce in January, the “Internet Debacle Index” continued its freefall.

Internet Debacle Index

At the market peak, this index (previously dubbed “Internet Insanity Index”), had 75 stocks with a market cap of $1.26 trillion. Currently, there are only 60 stocks, with a combined market cap of just $290 billion (down $970 billion)!

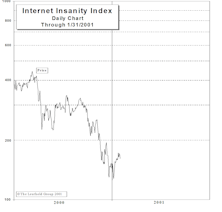

Internet Insanity Index

The Internet Insanity Index had a big bounce in January. These stocks were severely beaten down and a bounce was expected.

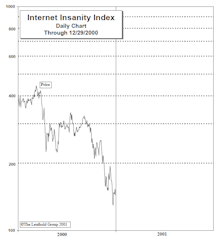

Internet Insanity Index

The Internet Insanity Index continued to lose ground in December, However, the 4.6% loss was not nearly as devastating as the 36% loss recorded in November.

View From The North Country

Individuals are sincere about investing appropriately, but get virtually no advise about risk. Also, putting the speed and volatility of the internet revolution in perspective.

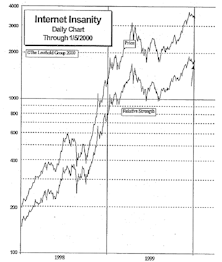

Internet Insanity Index: Performance Dichotomy

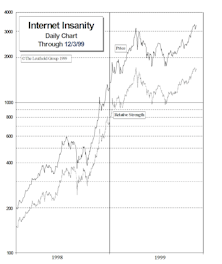

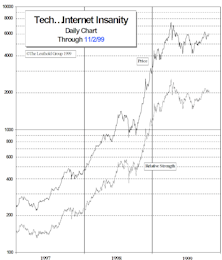

The Leuthold Internet Insanity Index gained over 11% during the month of December, and reached a new all-time high on December 13.

Internet Insanity Index: Breaking Out

The Leuthold Internet Insanity Index gained nearly 23% during the month of November and, for a short time, broke above the prior high reached in April of this year.

View From The North Country

The Internet threatens retail profitability by creating severe pricing pressure. For consumers the Internet has obvious benefits, but the downside is less obvious.

Internet Insanity Index: Short Sellers Heaven (Or Hell?)

The 66 components of the Leuthold Internet Insanity Index gained an average of 6.4% during the month of October, to bring the gain on this index to +84% year to date.

Internet Insanity Index

Most Internet companies enjoyed a surprisingly steady rise in share prices during the volatile month of September.

Internet Insanity Index

August was a volatile month for most of the “dotcom” companies.

Internet Insanity Update

Significant merger and acquisition activity in the past month has done little to bring buyers back into the sector.

Dissecting the Internet Play

Internet classification too broad and confusing. Tracking performance of the Internet necessitates breakout into three, distinct sectors: Technology…Internet Services, Consumer…E-Tail and Technology…Inter/Networking.

Internet Insanity Index

This Internet Insanity Index quantifies the mania which has swept up the Internet stocks over the past two years. It is constructed of first and second tier Internet components—technology companies that have been integral to the evolution of the Internet and retail companies which have gone through the roof by the mere mention of selling their wares over the Internet.