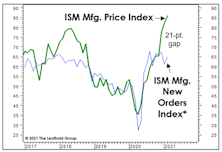

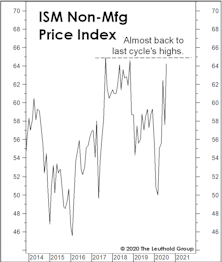

ISM Price Index

No Longer An Emphatic “NOPE”

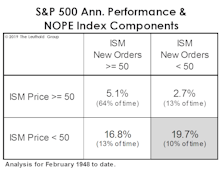

While the MTI’s Cyclical category remains hostile at -3, we’ve observed steady improvement in its leading inflation components. Especially notable is the reversal in the NOPE Index (ISM New Orders Minus Price Index).

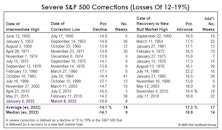

Special Study: Should You Buy The Dip? Some Statistical Considerations…

The correction in the S&P 500 since its high on January 3rd qualifies as a “severe” correction, which we define as a decline of at least -12% based on daily closing prices. What are the odds that it becomes a “major” decline*—in which the loss exceeds -19%?

In Section I, we review the history of severe corrections since 1950. In Section II, those corrections are analyzed in the context of the economic cycle, consumer sentiment, and other underlying factors—ones that might help us determine if today’s stock-market weakness is “buyable.”

Manufacturing: More Citations For Speeding

It is much easier to predict inflation, itself, than to predict when investors will become traumatized by it. Some of the most helpful measures for the latter task come from the ISM Manufacturing Report. October’s readings saw three key measures above the statistical “speed limits” we calculated years ago.

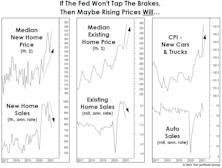

Are High Prices A Form Of “Tightening?”

It’s certain that today’s cyclical bout of inflation will prove “transitory,” if only because the word itself is practically meaningless. Our time on earth will also prove transitory, and so too will the current stock market mania—to the shock of most of the nearly 20 million “investors” on the Robinhood platform.

Inflation Watch

April ISM readings, both for Manufacturing and Services, were hot across the board. That’s good news for a still-recovering Main Street, but it manifested in ways that have frequently caused problems for a famous Street located in Lower Manhattan.

Still Heating Up…

The Fed’s reflationary efforts are showing up everywhere except in the measure that’s engineered specifically to minimize them—the Consumer Price Index. It’s a virtuous circle, until it is not

NOPE And NOPE!

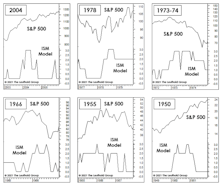

The calendar would say the U.S. economic recovery and bull market are very young, yet there’s an astounding array of “late-cycle” activity occurring on both Main Street and Wall Street. In the manufacturing economy, bottlenecks have reached levels that have historically been troublesome for stocks.

Early-Cycle “Overheat?”

Equities continue to benefit from an odd combination of faith and doubt in the Federal Reserve: Faith that the “Fed put” under financial markets is struck closer to the price of the “underlying” than ever before, and doubt that limitless liquidity will trigger a dangerous rise in consumer prices. In all fairness, this glass half full assessment is hardly a theoretical one, but one based on years of empirical evidence.

Heating Up Quickly

Inflation surprises have run hotter in the U.S. than in the rest of the world, no doubt reflecting the strength of major currencies versus the U.S. dollar.

An Unwelcome Surprise?

Several measures of U.S. economic “surprises” have soared to all-time highs in the last couple of months, showing that even economic forecasters have finally learned to play the corporate game of “under-promise then over-deliver.” Mind you, that’s only 30 years after most industrial firms eliminated the role of “staff economist.”

ISM Shows This Is A Different Kind Of Cycle

The manufacturing economy has thrown us a deflationary curve in 2019: The Price Index broke down in advance of New Orders, a reversal of the textbook recession/recovery sequence between these two measures.

Thoughts On The Commodity Bounce

The global economic expansion will enter its eighth year later this summer, yet the world’s central bankers continue to fight deflationary demons as if it’s 2008.