Large Cap Growth

The Mysterious Affair of Style Returns

Mystery writers are fond of creating misdirection by introducing multiple eyewitnesses that each describe the crime differently. This plot device confuses the storyline until a clever detective comes forward to unravel the conflicting evidence and solve the mystery.

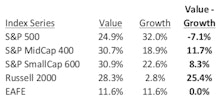

This scenario played out in style returns for 2021, as shown in Table. Our first witness is a large cap manager who tracks the S&P 500 and reports another banner year for Growth, its seventh win in the last ten years. Our second observer is a small cap manager who watches the broader market and tells of Value’s excellent year. Meanwhile, our third bystander is an international manager tracking EAFE, who reports seeing a whole lotta’ nothing in the style derby last year. In this study, we channel our inner Hercule Poirot to determine what, in fact, did happen across domestic style returns in 2021.

Ruminations On The Fed, Past And Present

If the “Maestro’s” image was dinged from being the “original bubble-blower,” imagine what will happen to Jay Powell’s if stock valuations mean-revert alongside interest rates and inflation over the next few years.

Style Rotation: Anything But Growth

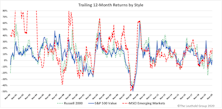

Driven by massive government stimulus, an imminent vaccine rollout, and the expectation of record earnings in 2021, investors seem to be on the verge of embracing a move away from Large Cap Growth stocks in earnest. The leading candidates offered as broad-based alternatives to Large Growth (LG) include Value, Small Caps, and Emerging Markets.

Research Preview: Rotating Away From Growth

This study examines Value, Small Cap, and Emerging Markets to see if they do, in fact, behave in a correlated manner when viewed as alternatives to Large Growth. The goal is to determine whether this trio of rotational favorites can be considered as broadly-equivalent replacements for LG.

Large Cap Growth, Without The FAANG

FAANG has dramatically outperformed Large Cap Growth the past ten years, but is has become cheaper and slightly less growth-oriented in the process. We examine the extent FAANG performance has carried through to the rest of the Large Cap Growth universe and how to get growth without them.

It’s Time To Choose

Which box do you check? The “status quo” or the “change of pace?” Keep in mind, the same decision in front of you turned out to be extraordinarily important four years ago. So, which will it be for 2020 and beyond? Large Cap Growth or Small Cap Value?

Inflation In The Wrong Places?

Long before policymakers’ extreme response to the COVID collapse, we feared that the Fed’s interventions were suppressing important signals from the stock and bond markets. But we now suspect that hyper-expansionary policies are suppressing price signals from the “real” economy as well.

.jpg?fit=fillmax&w=222&bg=FFFFFF)