Large Caps Vs. Small Caps

Schrödinger’s Style Box

The performance derby between actively managed portfolios and passive benchmarks is strongly influenced by market conditions. Active manager success rates are cyclical, but not random, and are driven by slippage created from style, size, and weighting considerations that result from the imperfect slotting of active portfolios into single style boxes. Moreover, this slippage can be defined and measured, and shows a clear correlation with relative return spreads between benchmarks and their opposite boxes.

Small Cap Synchronicity

Small cap stocks are often seen as a bullish, risk-on, pro-cyclical asset class. They benefit from economic growth, rising inflation, widening margins, and the willingness of investors to move out on the risk spectrum. The pandemic recovery has created these very conditions, and small caps responded right on cue by posting a blockbuster price gain of 130% since the COVID-19 bear market low of March 23, 2020. Because the pandemic was a global economic and health care catastrophe, we were curious to see if small caps behaved similarly in other regions.

Research Preview: Global Small Caps

U.S. small caps have posted blockbuster price gains coming off the pandemic bear-market low in March 2020. We were curious to see how international small caps have performed since then, and launched this project to learn how this asset class has recently behaved in other regions.

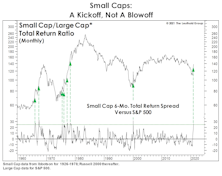

When “Overbought” Is Bullish

The recent months’ surge in Small Caps has been historic, and the Russell 2000 continues to register ridiculously “overbought” readings on many technical oscillators. In the short-term, that might be a cause for caution on the overall market. However (and perhaps counter-intuitively), this extreme strength cements our view that a long-term leadership cycle in Small Caps is underway.

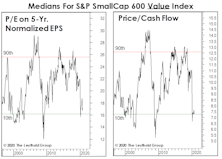

Small Value Or Small Growth? Yes!

If there’s an emerging bubble in Growth stock investing, it certainly doesn’t apply to Small Caps. The “usual” premium for Growth over Value within the Small Cap space is nonexistent—both segments look historically cheap.