Late Cycle Market

Youthful Rally Already Looks Old

For more than a year, we’ve characterized the U.S. economy and policymakers’ decisions as increasingly late-cycle in nature, but that probably doesn’t do justice to the U-turn in the investment backdrop.

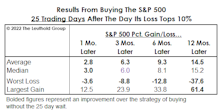

Too Early To Buy?

Many investors will instinctively salivate at lower prices, whether or not they represent good value. Is there a better way to temper this Pavlovian impulse and improve results? We found it’s better to wait 25 days before re-entering the market after a 10%-correction threshold is breached.

Deep Thoughts On The Recovery

Massive gains in stock market wealth have undoubtedly been a contributor to inflation, yet few analyses of the inflation picture even mention the stock market—other than to predict it will soar when inflation proves transitory.

NOPE And NOPE!

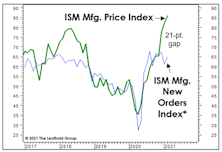

The calendar would say the U.S. economic recovery and bull market are very young, yet there’s an astounding array of “late-cycle” activity occurring on both Main Street and Wall Street. In the manufacturing economy, bottlenecks have reached levels that have historically been troublesome for stocks.

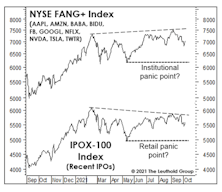

Let’s Concentrate For A Moment

In the immortal words of Lloyd Bridges, “Looks like I picked the wrong week to quit drinking.” Let’s put aside this week’s market turmoil and concentrate for a moment on... “concentration.” Market concentration, that is. Close your eyes and think back to those carefree days of mid-February.

Are Stocks And The Economy Disconnected?

The consensus among market pundits is that a U.S. recession will be averted and, as a consequence, domestic stocks remain the best game in town.

Small Caps: “What If?”

The Russell 2000 is the most important major index on the cusp of a new BUY signal. Our best guess is that Small Caps will still trend lower for now, creating a buying opportunity in the months ahead.

Building The Wall?

One of the more impressive feats that bullish pundits have pulled off is their successful portrayal of themselves as lonely and misunderstand contrarians even as the eleventh year of a cyclical bull market grinds on.

The Small Cap Discount Deepens

Small Caps typically underperform during a bull market’s final phase, and our findings with respect to the Output Gap aid our understanding of that phenomenon.

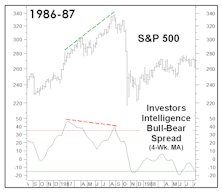

Divergence, Danger, And Delusion

The U.S. economy and blue chips have shrugged off the risk of the worst trade war since 1930’s Smoot-Hawley Act, while comparatively few stocks on either the NASDAQ or the NYSE have broken out to 52-week highs. There’s also the troubling talk of the Fed having tamed “the cycle.” Should investors bet on a potentially wild (but narrower) final melt-up over the next 6-12 months? We don’t like the odds.

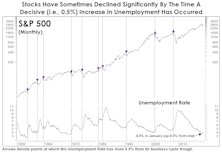

Unemployment And The Point Of No Return

We’ve done extensive work on the yield curve, but until now had entirely overlooked an employment-based recession indicator that’s lately come into focus.

Value, Momentum, And The Stock Market Cycle

Conventional measures of market action, like breadth and industry leadership, point to the formation of a bull market top. Divergences abound.

.jpg?fit=fillmax&w=222&bg=FFFFFF)