Median Valuations

A Look At Where Rate Hikes Are “Working”

Speculative spirits are back, and the index that’s suddenly close to its 2021 high is the one we viewed as the epicenter of the mania—the NY FANG+® Index!

Easy Money? Not In Small Caps

One might have predicted that big beneficiaries of war-time-style levels of federal spending, financed by money printing, would be Small Cap stocks. And from March 2020 until March 2021, they were. But the larger picture is sobering.

A Squandered Small-Cap Opportunity?

We know our view on this is controversial, but we like the relative prospects for Small Caps—even though we still believe the broad stock market is currently the most speculative one in U.S. history.

A Small-Cap Theory Of Relativity?

Small Cap median valuations are among the highest in our 40-year database, but they are bottom quintile versus the nose-bleed level of the median Large Cap. If this Small Cap leadership cycle only matches the shortest one on record, it will last another three years. Based on the valuation gap, that guess seems conservative.

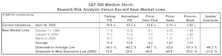

New Era Valuations?

We understand the various rationale for the upward shift in equity valuations seen over the last quarter century or so. Unfortunately, wiping away all market history prior to 1995 does not make stock valuations appear significantly less inflated.

If You Like TINA, You Should Love “SAMARA!”

Equity investors have had a multi-year love affair with TINA—the belief that “There Is No Alternative” to stocks in a world of ridiculously-low interest rates. This TINA romance has carried on so long that the S&P 500 is nearing valuations last seen in the Tech bubble’s final inning. If the fling with TINA has become prohibitively expensive, we’d like to introduce “SAMARA.”

Small Cap Catch-Up?

The big jump in Small Caps over the last two weeks has entirely reversed the segment’s summer underperformance and has technicians feverish about another “breath thrust.” Technically, it’s impressive, but we are more intrigued by the fundamental potential for continued Small Cap (and Mid Cap) outperformance.

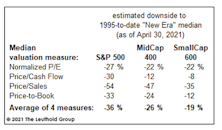

Median Valuations: Down, But Not Cheap

If we assume that valuations will “bottom” at the “richest” levels ever seen at a bear market low, there’s still 32% downside remaining in the median S&P 500 stock.

.jpg?fit=fillmax&w=222&bg=FFFFFF)