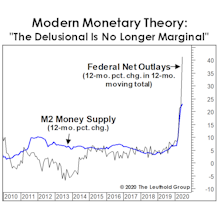

Modern Monetary Theory

Sharing The Punch Bowl?

The gap between YOY growth rates in M2 and nominal GDP just flipped negative after four quarters of record-high readings. In other words, the recovering economy is now drinking from a punch bowl that the stock market once had all to itself. Similar drinking binges occurred in 2010 and 2018, both of which then experienced corrections north of 15%.

Ulterior Fed Motives?

In an echo of last decade, the Fed has come under fire for keeping crisis-based monetary policies in place well after a crisis has subsided. Predictably, the Fed rationalizes its uber-accommodation by citing the slowest-to-recover data series from a set of figures that already suffer from an inherent lag (labor market indicators).

What Should Quants Count?

On May 25th, Fed Chair Jerome Powell promised to pull back emergency support “very gradually over time and with great transparency.”

“Very gradually?” No one doubts that. But “with great transparency?” Not a chance...

Measuring The Cost Of “Free”

The S&P 500 and NASDAQ have lately traded as if the hybrid “Fed/Treasury put” entails no cost at all. But dollar alternatives—like forex, precious metals, and crypto-currencies—are saying, “Not so fast!”