MSCI Developed Country

“Provincialism” Pays

After the last two months’ violent reversal of the “re-opening” trade, the major indexes for U.S. Large Cap, Small Cap, Growth, and Value all stood with YTD gains in the 14-16% range. Yes, a few nimble portfolio managers might have migrated out of “re-opening” stocks in early April and into the “old” Large Cap Growth leadership but the surest route to superior performance has been to avoid what’s become an almost annual pitfall since the Great Financial Crisis: Foreign stocks. EAFE and MSCI Emerging Markets already trail the S&P 500’s 16.0% YTD gain by about 8% and 12%, respectively.

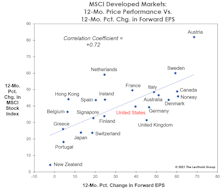

Visualizing U.S. Stock Market Dominance

It’s near the year’s mid-point and U.S. equities are doing what they’ve done nearly every year since the onset of the Great Financial Crisis: trouncing their foreign counterparts. The S&P 500’s YTD gain of 13.5% is about 500 basis points better than EAFE’s, and 800 basis points above that of the MSCI Emerging Markets Index.

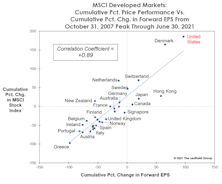

The Global EPS Rebound

For years, we’ve noted the increasing valuation gap between domestic and foreign stocks. And for years, we contended that the most likely catalyst for a narrowing of that gap would be a recession-induced cyclical bear market in stocks. Evidently the 2020 bear market was not big enough to do the job.

It’s Demographics, Stupid! (Not The Economy.)

Turn on financial television at any random time, and you’re likely to soon hear the argument that still-high U.S. stock market valuations are “justified” by extremely-low interest rates. We’ve countered that these low U.S. rates are simply a reflection of the secular slowdown in economic and earnings growth.

.jpg?fit=fillmax&w=222&bg=FFFFFF)

_Page_1.jpg?fit=fillmax&w=222&bg=FFFFFF)