MSCI Emerging Market

The Global EPS Rebound

For years, we’ve noted the increasing valuation gap between domestic and foreign stocks. And for years, we contended that the most likely catalyst for a narrowing of that gap would be a recession-induced cyclical bear market in stocks. Evidently the 2020 bear market was not big enough to do the job.

EAFE And EM: Long Past Their “Peaks?”

We applied the “Peak Cash Flow” valuation methodology to the EAFE and MSCI Emerging Markets Index and found them both priced at only about one-half of today’s MSCI U.S. multiple. However, the ratios are already above anything achieved during the 2009-2020 global bull market.

EM Equity Purgatory

Nine months ago we established a “pilot” position of 4% in Emerging Market equities in the Leuthold Core Fund, based mostly on the bullish inflection in a long-term technical indicator (VLT Momentum).

Jury Is Still Out On EM

Emerging Market stocks have been swept up in the last month’s rally in all things cyclical and high beta. Nonetheless, the MSCI Emerging Markets Index is still down marginally from its level coinciding with its April 30th VLT BUY signal.

Adding EM On A Rent-To-Own Basis

The Major Trend Index has remained in neutral territory during the last several weeks of upside action, suggesting there remain significant fundamental and technical shortcomings beneath it all. But this precarious MTI stance didn’t preclude us from acting on a new bullish reading for Emerging Market equities at the end of April.

Adding Some Emerging Markets On A “Rent-to-Own” Basis

Emerging Market equities have been modest underperformers during the current rally, but they’ve marshaled enough strength to trigger a new low-risk BUY signal on our VLT Momentum algorithm at the end of April.

Bottom-Spotting In Foreign Stocks

The tale of two markets has existed for years, but now it’s getting ridiculous.

Emerging Markets: Not Persevering, Just “Preserving”

We’ll never know how world events might have evolved had Mitt Romney won the presidential election in 2012. But thanks to the wonderment of Emerging Markets’ underperformance, we can go right back to the last days preceding that fateful election.

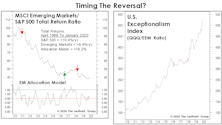

Foreign Stocks “De-Coupling”

Market action has been broader and better than we expected given monetary conditions, and Small Cap strength seems to lend credence to contention that rates aren’t yet high enough to bite.

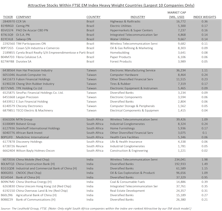

MSCI EM Reclassification: Achiever & Aspirers

EM segments on the “Aspirer” watch list for MSCI annual market reclassification: China A-shares and Argentina. The “Achiever,” Pakistan, just recently started trading as a new member of MSCI EM Index.

Global Valuation Checkup

Foreign equities beat the U.S. in the first quarter, but the performance gap that’s opened up since the 2007 market highs remains astounding. While foreign equity valuations (especially within EM) have rebounded from February 2016 lows, the bounce has done little to close the enormous P/E discounts relative to the U.S. market.

EM: The Case For Waiting...

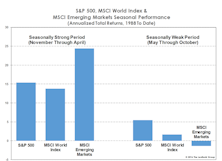

We’ve mentioned that concerns over potential seasonal weakness in September and October seem pronounced this year, perhaps because the year has so far turned out a pleasant surprise following its horrendous start.

MSCI To Include Foreign-Listed Chinese Stocks For First Time

MSCI will soon announce the results of its semi-annual index rebalance and, for the first time, overseas-listed Chinese companies will be included in the MSCI Emerging Market and China Country Indexes.

Emerging Markets: A Half-Off Sale!

The Chinese government’s repeated stock market intervention attempts over the past several weeks have been remarkable, and obviously antithetical to the country’s move toward a more laissez faire corporate environment.

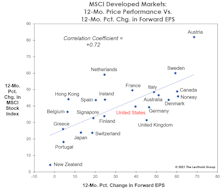

A Kind Word For “Forward Earnings”

Our criticism of the widespread trust in “forward earnings” has sometimes been harsh, but consider the following: the latest 12-month forward EPS estimate for the EAFE index is $122.71, virtually matching the forward estimate that was made in January 2006.

U.S. Versus Foreign Stocks: More Of The Same

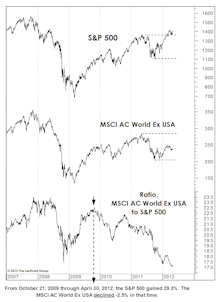

Long before the U.S. dollar began to rebound, the current bull market in global stocks had already favored “provincial” portfolio managers focusing solely on U.S. stocks.

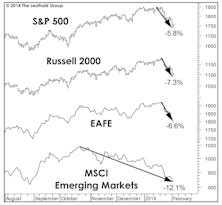

Polar Vortex Hits The Markets Too

The stock market kicked off 2014 with a (so far) shallow bout of weakness which we don’t consider to be the start of a new cyclical bear market or even a deep correction.

Stock Picking Opportunities From Emerging Market ETFs

Changes in a major EM ETF’s benchmark and another big player’s new EM ETF introduction could provide stock pickers opportunities in select Emerging Markets.

No Place Like Home

How is the U.S. stacking up relative to foreign markets since 2009 market lows?

Effective Momentum Driven Sector Rotation In Emerging Markets

Momentum has proven to be an effective factor in emerging market sector rotation strategies. Even better than in U.S. markets.

.jpg?fit=fillmax&w=222&bg=FFFFFF)