MSCI Ex-USA

Are Foreign Stocks Cheap Enough?

For those who must remain fully invested, an interesting (if not sickening) feature of the bear market is that those who entered it loaded with the most expensive and “trendiest” stocks and sectors have lost the least.

The Downside Leaders Look Familiar

It wouldn’t be a December Green Book without at least one page of hand-wringing over the year’s extreme underperformance of foreign stocks.

Assessing The Damage

Our tactical accounts remain positioned very defensively, and we have yet to see the sort of capitulative market action that would lead us to lift any existing equity hedges.

The Two-Tiered Global Market

We should emphasize that our characterization of stocks as dangerously overvalued applies only to the U.S. market.

America’s Already First...

Thanks to the U.S. dollar’s recent spike, foreign equities in dollar terms declined during November while the U.S. markets were celebrating a Trump victory. Thirty-nine of the 49 MSCI country indexes are in bear market territory from the perspective of a dollar-based investor.

Foreign Equities: Cure For Altitude Sickness?

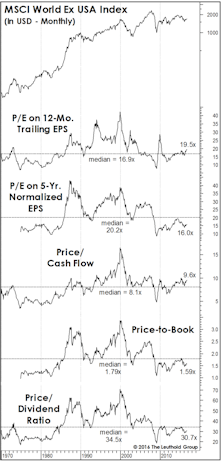

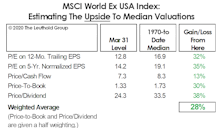

When we complain about the stock market’s inflated valuation levels, we’re unintentionally giving short shrift to the 50% of the global-market capitalization that resides outside the U.S. We’d be hard-pressed to describe the valuation of Developed foreign markets as any higher than neutral.

Xenophobia Gone Too Far?

Donald Trump’s all-but-certain Republican nomination is somehow a fitting capstone to a stock market era in which it’s paid to be provincial.

.jpg?fit=fillmax&w=222&bg=FFFFFF)