Oversold

Yelling “Fire” In A Crowded Theater?

The latest market down-leg triggered one of our short-term breadth oscillators into super-oversold territory. While “oversold” may sound bullish to most contrarians, when SPX becomes as internally weak on a 10-day basis as it did in early October, there’s usually another shoe to drop.

From “Thrust” To “Bust” In Three Weeks

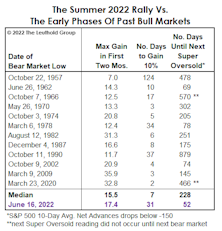

If a new bull began in June, the August 31st “super-oversold” signal would be the first ever during the first three months after a bear market low. In 1962, such a reading occurred in the bull’s fourth month—which is probably why some analysts are now using that year as a possible analog for the rest of 2022.

Down, But Hardly “Oversold”

Historically, a good measure of a fully oversold market has been a drop to negative by our VLT Momentum algorithm. YTD, it has been on the downswing, but is still in the vicinity of its highs reached during the Trump Bump. If the May bottom in the S&P 500 turns out to be the final low for the decline, VLT would be one of many suggesting the new rally is among the riskiest in market history.

Isn’t That Super?

Washed-out investor sentiment and “oversold” stock market oscillators are usually good reasons to get more invested in stocks. But in the case of super-oversold conditions, it is commonly a forewarning that another wave of selling is yet to come.