Pharmaceuticals

Advertising Leads This Week

Pharmaceuticals and Advertising were this week's best groups. Internet Retail and Precious Metals were this week's worst groups.

Railroads Chug To A Lead

Pharmaceuticals and Railroads were this week's best groups and Managed Health Care and Department Stores were this week's worst groups.

Current Attractive & Unattractive Groups and Highlights

Beverages is one of a handful of “defensive” groups which has staged a comeback in our ratings during the last few months.

Highlighted Groups

Information Technology has largest representation among Attractive groups; only one Tech group rated Unattractive. Highlighted Attractive groups include Tech Distributors, Construction/Farm Machinery, Aerospace/Defense, and Pharmaceuticals.

Companies Moving The Pills – Why We Still Like The Theme

Favorable dynamic are intact, including demographic trend and increased use of generics.

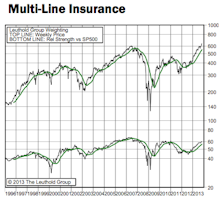

Highlighted Attractive Domestic Groups - November 2013

Multi-Line Insurance, Health Care Equipment, Pharmaceuticals and Automobile Manufacturers.

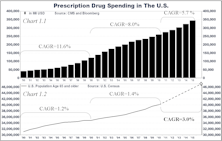

Drug Retail - Ride The Rising Tide Of Prescriptions

Drug Retail and other related groups could be poised to ride the rising tide of prescription drug spending.

Big Pharma & The Rise Of Branded Generics

A number of pharmaceutical giants are diversifying their business endeavors to offset increasing risks. Some are branching into the world of branded generics—generic drugs with recognizable brand names.

Adding Pharmaceuticals: Cheap Stocks

Within the Select Industries portfolio, a new holding was established in the Pharmaceuticals group, boosting Health Care exposure in this equity portfolio to an overweight 34% (versus S&P 500 weight of 12%).

Booster Shot Of Health Care...Activating Pharmaceuticals & Health Care Facilities

Initiating new portfolio positions in Health Care Facilities and Pharmaceuticals. Former Generic Pharma portfolio holdings now being rolled into the broader Pharmaceuticals group.

Health Care's Top 20 Stocks

Highlight on the Health Care sector: Relative Valuations, Top Twenty Components, P/E Ratios, PSR, and Gross Profit Margins.

Health Care's Relative Value

It is well-known that valuations for U.S. large-caps have compressed dramatically since their late 1990s heydays, and among all large-caps the cheapest of the cheap may be the health care stocks.

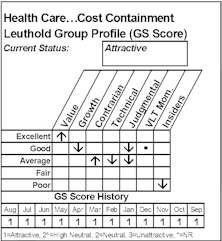

Big Pharma Finally Added To Portfolio

As contrarians, we have been looking for an opportunity to establish holdings in this down and out equity group. May GS Scores finally ranked it as Attractive for the first time since July 2003.

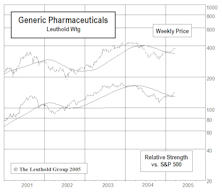

Adding Small Dose Of Generic Pharmaceuticals To Portfolio

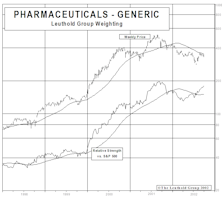

Injecting small starter position of Generic Pharmaceuticals into the Select Industries Portfolio, bringing exposure to Health Care sector to a modest overweight position.

Weakness In Health Care GS Scores

Health Care was our top-ranked sector from March 2003 to February 2004. Since that time, the sector’s composite score has steadily fallen.

Sector Spotlight: Health Care

Conceptually we think that the big drug stocks are poised to rebound, but they have yet to rank Attractive in the Group Selection Scores.

Client Questions And Answers

A look at why our very overweight Healthcare position and zero weight in Financials has not hurt our performance this year.

Cutting The Drug Business Five Ways

We’ve carved out subsets from Wall Street’s oversimplified classification of drug stocks.

New Select Industries Group Holding: Prescribing Generic Pharmaceuticals

Upgraded to Attractive for October as a result of three consecutive months of rising quantitative scores.

New Select Industries Group Holding: Now Adding Pharmaceuticals

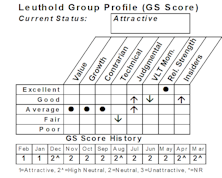

GS Score improved to Attractive on strength from Growth, Technical, Judgmental, and Insider categories.

New Select Industries Group Holding: Selling Drugs To Shop Department Stores

Upgrade to Attractive last month put Department Stores on our radar, and February’s move into the GS “top ten” confirms the quantitative strength of this group. Improving technicals, stronger than expected January sales and increasing probability of soft landing indicating a promising outlook for this group.

New Select Industries Group Holding...Adding Pharmaceuticals And Deactivating Biotech

With the improvement of the Pharmaceutical group within our GS Score rankings to attractive, along with Biotech’s fall from grace (all the way to unattractive), we are getting a chance to make a move into the drug stocks.

Health Care...Major Drugs Returns to Portfolio

“Major Drugs” hit Attractive in June, slipped to High Neutral in July, and moved back to Attractive in August.

We Like the Drugs....But Not Yet

Back in August of 1990, this publication issued a warning, “Don't Get Too High on Drugs”. This five page article concluded that ethical drugs were “potentially one of the most vulnerable sectors in the entire market.” In retrospect, this anti-drug warning has proven to be one of our better calls.

View from the North Country

The Ross Perot Factor... Coming Off the Drug Related Highs (The Drug Stocks)...Is The U.S. The Land of Cheap Labor and Long Hours?

Don’t Get Too High On Drugs

As often noted in these pages, as far as stock prices are concerned, investors’ perceptions are often more important than reality. Political focus on the Ethical Drugs will take its toll on drug industry P/E’s, even if nothing ever comes of it.

Drug Stocks and the Dollar – Some Words of Warning

Drug stocks a play on the weak dollar?...perhaps not as good a play as most think. Herein we compare the market performance of drug stocks with the dollar from 1975 to date.

Should Still Another Wall Street “Truism” Be Retired? Drug Stocks and the Dollar

If you believe drug stocks are really a play on future weakness in the dollar, you better read this study. We like the drugs, but not for this reason. Drug stocks at one time were sensitive to dollar fluctuations but over the last four years this has not been the case.

Health Care Today and Tomorrow....And One Specific Investment Opportunity Area

In recent years health care stocks have developed a bad case of two tier-ism. Health care service issues have been hot numbers while more traditional health care issues, primarily the big ethical drug issues languished. From now on it may be the other way around.