Pre-Recessionary

Be Contrary On Discretionary

The Fed’s June announcement of a pause with further rate hikes to come has extended the uncertainty of whether an inverted curve and persistent policy tightening will ultimately lead to a recession. The business cycle is a critical investment issue because the relative returns of many assets depend on the state of the macro economy. This study examines the Consumer Discretionary (CD) sector’s behavior in recessionary times, with the goal of understanding the typical performance pattern during economic lows in order to help investors position their portfolios for a potential recession.

Even The Labor Market Looks Recessionary

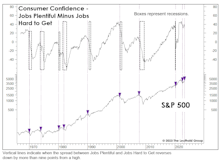

We think the stock market is skating on pre-recessionary thin ice, an endeavor that, admittedly, can be both irresistible and (temporarily) profitable.

Just A Typical Pre-Recessionary Rally?

Is the stock market disconnected from a souring economy? It might seem that way, and the topic dominated the discussion at the recent Market Technicians Association annual symposium.

Research Preview: Recessionary Discretionary

While sentiment on the potential for a recession by year-end is split, there is little dispute that it’s an important question for cyclical sectors. Consumer Discretionary is most exposed to the business cycle, and we are interested in understanding its prospects as we head toward a potential economic slowdown.

No Punch Bowl? No Problem!

Stocks are off to a strong start in 2023, and speculative juices are again flowing. In the final week of January, NASDAQ trading volumes were eight times those of the NYSE, a level seen only at the very peak of the meme-stock mania in early 2021. (Pre-COVID, the ratio oscillated between two and three. It’s a brave, new world.)