Put/Call Ratio

Don’t Trust The Thrust…

Jay Powell’s speech on November 30th triggered a 1,000-point intraday reversal on the DJIA and left us wondering who might have slipped the Chairman a recent copy of the Green Book.

Watching The “Smart Money”

Of the prevailing bullish arguments, the one that strikes us as the weakest is that there’s “too much pessimism.” Much like in 2000, some pundits disingenuously made that claim before the market rolled over. But at this point, with the market now down big and economic numbers suddenly wobbly, the last thing any bull should want is too much pessimism.

Sentimental Musings

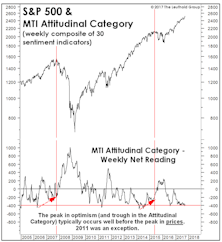

We get irked when TV pundits misrepresent the mood of equity investors as unduly pessimistic based one or two (or zero) data points. Among the dozens of “Attitudinal” indicators we track, an overwhelming majority show professional and retail investors have jumped back into the fray.

“What, Me Worry?”

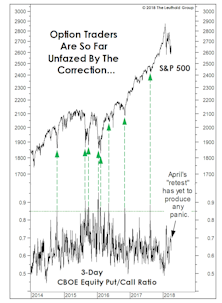

Our shortest-term put/call measure has yet to reflect the level of fear usually triggered by a correction of this size. Meanwhile, the market setback has done almost nothing to stymy the optimism of either market newsletter writers or mutual fund timers.

Thoughts On Sentiment

The MTI’s Attitudinal category has held stable over the last several months, an impressive (and contrarily bullish) feat considering the steady onslaught of new bull market highs.

Score One For The “Smart Money”

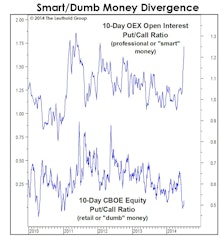

We try to avoid the popular practice of “cherry picking” a few indicators to fit our stock market forecast, a reason we evaluate more than 130 measures in calculating the Major Trend Index. But last month we couldn’t resist highlighting the exciting face-off between the professionals and the public.

The Public And The Professionals Square Off

Two short-term, options-based sentiment measures have just swung to levels consistent with near-term difficulty for stocks. Current reading is the most bearish combination of smart-money caution and dumb-money confidence in 10 years.

Sector Strategy: Put Your Money Where The “Puts” Are

Quantitatively, we have found that option trading volumes provide good, contrarian information on investor sentiment toward market groups.

Sentiment Still Supportive

Sentiment measures still show pessimism among investors. Doug Ramsey looks at the current sentiment gauges for the market and also examines the current sentiment readings for 24 broad industries groups.