Rally

Pause, Or Paws?

The one-year anniversary of the 2022 bear-market low occurs on October 12th, yet—after all this time—we’re not confident enough to declare it as the bull’s first birthday.

We’re interested to see whether or not CBNC breaks out new baseball caps for the occasion, as they did in the late 1990s for “Dow 10,000.”

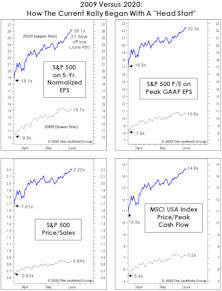

The Wrong Kind Of “Head Start”

The rally’s initial resemblance to the first up-leg off the secular 2009 market bottom is remarkable. Both rallies started in March, and achieved gains of almost 40% within 50 trading days. Both, of course, sprung from a backdrop of unprecedented monetary stimulus.

Can The Rally Recover From Its 0-For-8 Start?

The current rally is either the first upleg of a new bull market, or the second-largest bear market rally in the last 125 years. The lone development that can settle the issue is for the S&P 500 to move above its February 19th closing high of 3,386.15.

A Bounce Without “Oomph”

One would think that one of the most explosive market rallies of all time would trip-off all the traditional “breadth thrust” signals, or maybe even invent a few of its own. Sorry, no luck.

We’re All Economists Now!

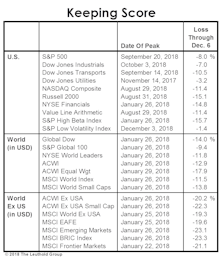

It’s now been more than 19 months since global stocks peaked on January 26th, 2018. Those lucky enough to have been invested solely in the S&P 500 and to have held on for the volatile ride have a 3.7% gain to show for it. Nice going.

Reliving ‘99... Tick By Tick

Current leadership trends continue to track their 1998-99 behavior in an almost eerie fashion—so much so that we now wish we’d used that historical period as our instruction manual!

Rally Like It’s 1999

Similarities between 2019’s YTD up-move and the late-2018 recovery are so striking they must make even the most vociferous bear queasy. The trends are identical, but the magnitude of both the absolute and relative performance movements was greater in the earlier experience.

1999 Redux

As the market rebound has extended, we’ve noted its striking similarities with the rally of 1999—one that might have been the most speculative in U.S. history.

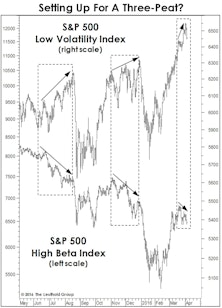

A High-Risk Rally

During the market bounce over the last few weeks, we reminded ourselves and others of the old maxim that “bear market rallies look better than the real thing.” Evidently, the stock market overheard us and took the advice as marching orders.

Sizing Up The Rally

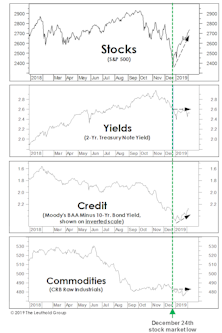

There’s an old saying that bear market rallies look better than the real thing, yet the upswing off December lows looks even better than the typical bear market rally.

Bull Pause, Or Bear Paws?

The old maxim says that when the bears have Thanksgiving, the bulls have Christmas.

Have We Already Had The Year-End Rally?

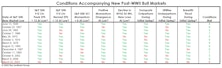

In the March Green Book, we discussed the long history of stock market difficulties during mid-term election years. Incredibly, nine of the past 11 cyclical bear market lows have occurred in these years, with eight of those nine recorded during the seasonally-weak months of May through October (Table 1).

Stock Market Observations

The stock market rally off the February 11th lows has been powerful enough to lift the Major Trend Index into its Neutral zone (in fact, a high-neutral ratio of 1.04), and therefore certainly deserves some level of respect.

.jpg?fit=fillmax&w=222&bg=FFFFFF)

.jpg?fit=fillmax&w=222&bg=FFFFFF)