Ratio of Ratios

Small Cap Valuation Check

We don’t have a strong capitalization-bet recommendation, other than to remind readers that Small Caps have been especially responsive to the favorable seasonal window that began November 1st (and which extends through April 30th).

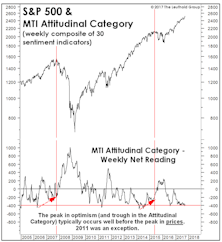

Thoughts On Sentiment

The MTI’s Attitudinal category has held stable over the last several months, an impressive (and contrarily bullish) feat considering the steady onslaught of new bull market highs.

Small Caps: The P/E Premium Lives On…

Small Cap valuations may look better on a relative price-to-book basis, but we still believe their Normalized P/E ratios will suffer further compression before Small Caps reclaim the leadership baton.

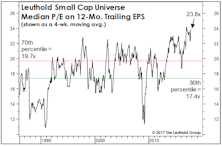

Small Cap P/E Ratios: Not Yet Low Enough

When the Fed surreptitiously began to tighten as we believe (via tapering), in January 2014, history suggested that Consumer Discretionary and Small Caps would be the most likely initial market victims (at least from a relative perspective).

Small Caps: A New Ratio!

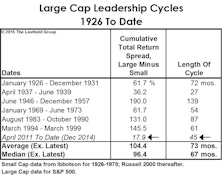

Small Caps lagged the S&P 500 by almost ten percentage points in 2014, but their underperformance streak technically dates back to April 2011. Nonetheless, their cumulative, 45-month underperformance in relation to the S&P 500 (now about –18%) is still modest enough that any mention of the current “Large Cap Leadership Cycle” is bound to draw a few head scratches.

Small Cap Premium Finally Shrinks—But Remains Historically Extreme

July’s Russell 2000 -6% rout finally deflated some of the Small Cap valuation premium we’ve been grousing about in recent years.

A Milestone You Might Have Missed

The fifth anniversary of the bull market was met with fanfare, but the launch of the Large Cap leadership cycle in April 2011 is receiving no attention whatsoever.

How Long Can Small Caps Lead?

The Russell 2000 is about five points ahead of Large Caps YTD, and is approaching its April 2011 long-term relative peak. We view this outperformance as their leadership’s last gasp and not a new cycle.

Valuations & Future Returns

The U.S. market rates anywhere from mildly overvalued to very overvalued relative to other developed markets. Foreign markets might be the last remaining pocket of yield that isn’t overvalued.

Secondary Stocks/Big Cap Stocks

Secondary stock measures were up 7%-9% in November compared to 5%-6% for the capitalization weighted measures. All we can say is, it’s about time!

The Shift to Secondary Stocks

March was another strong relative month for secondary stocks. We are now operating under the assumption that a significant shift in market character has occurred.