Retail

Momentum: “New Junk” In The “Old Trunk”

March 23rd marked the one-year anniversary of the COVID-19 bear-market bottom. We are all eager to turn the page on the pandemic ordeal and move forward to brighter days ahead. Looks like some big help is coming our way.

Spring Forward, Fall Back?

The S&P 500 has gained about 5% on the year, respectable but hardly consistent with the “melt up” scenario we thought might occur.

Retail Fades; Other Consumer Themes Flourish

Shifting consumer preferences and the relentless rise of e-commerce are changing the sector’s beneficiaries of the healthy backdrop away from retail, yet other Discretionary opportunities abound outside of the traditional retail groups.

Retail Theme Compelling; Purchased Hypermarkets

Retail-related industry groups continue to strengthen in our GS Scores, and Hypermarkets & Super Centers is one of the top rated groups in our rankings. This also gives exposure to Consumer Staples, currently the highest rated among our composite sector scores.

Retail Groups Rise In The Ranks

A new theme emerging within our GS Scores—Retail related industry groups are flocking to the upper rankings of the scores.

Retail Rebound?

“Retail Rebound?”, a new Leuthold sector, among the Q1 performance leaders...may not remain there if economic progress reverts back to sluggish.

Retailing Resurgence Update

"Retailing Resurgence” held up well in November and we have not given up on Santa Claus yet.

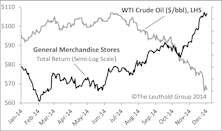

Yes, Virginia, Consumers, Investors and Retailing Stocks Are Aligned. It’s Time for a “Retailing Resurgence”!

Consumer confidence is high, the economy is solid. We do not think Christmas 1994 is yet reflected in many retailing stocks. Look at this like a retailing “bounce" opportunity.

.png?fit=fillmax&w=222&bg=FFFFFF)