Return Spread

The Active/Passive Performance Cycle Second Quarter 2022 Update

The performance derby between actively-managed portfolios and passively-managed index funds is a topic of ongoing interest for Leuthold clients and the investment community at large. Therefore, we are providing an update to all charts and tables of our Active/Passive performance analyses.

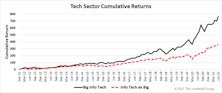

Big Time

Market environments are driven not just by industry preferences, but also by a bias toward the very largest companies. We have developed a new set of groups composed of the 10 largest companies from each sector. With several of these baskets sporting positive rankings, we felt a closer look was in order.

A Look At The Small-Cap Setback

The Russell 2000 has blown the 14% lead it had built against the S&P 500 earlier this year, and now trails the index by almost 5%. Has that type of intra-year reversal happened before, and, if so, did it portend a major change in leadership?

Schrödinger’s Style Box

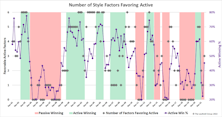

The performance derby between actively managed portfolios and passive benchmarks is strongly influenced by market conditions. Active manager success rates are cyclical, but not random, and are driven by slippage created from style, size, and weighting considerations that result from the imperfect slotting of active portfolios into single style boxes. Moreover, this slippage can be defined and measured, and shows a clear correlation with relative return spreads between benchmarks and their opposite boxes.

Kindred Spirits: Financials And The Value Style

Investors looking for the long-awaited rebound in the Value style point to the potential for rising interest rates as a possible driver of style rotation. Higher rates would benefit many Financial companies, a sector closely linked to the Value style. In fact, many commentators believe that the Value style cannot experience a major run without the participation of Financials. We launched a research effort to examine the link between Financials and Value, seeking to understand whether there is truth in this old saw, or whether this connection is more properly classified as market folklore.

Research Preview: Are Financials And Value “Best Friends Forever?”

Investors looking for the long-awaited rebound in the Value style point to the potential for rising interest rates as a possible driver of style rotation. Higher rates would benefit many Financial companies—a sector closely linked to the Value style. In fact, numerous commentators believe that Value cannot experience a major run without the participation of Financials.

Profiting From Mighty Mites

One of the signature traits of the U.S. small cap market is the prevalence of money losing companies. A recent tally indicated that prior to Covid, 38% of small caps were reporting trailing year losses despite the widespread economic strength of 2019.

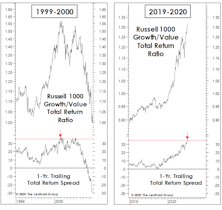

Different Paths, Same Ending?

For those who believe the economy “drives” trends in stock market leadership, consider the cases of 1999-2000 and 2019-2020.

Preview: The Importance Of Quality In Small Caps

One of the signature traits of the U.S. small cap market is the prevalence of money-losing companies. Our recent tally indicates that even prior to COVID-19, 38% of small caps were reporting trailing year losses despite the widespread economic strength of 2019.

A Small Cap Strategy Session

Leuthold’s research team has recently flagged a number of items that suggest it may be time to consider small cap stocks. This asset class has been showing signs of life and the decision to overweight small caps is starting to seem relevant – and perhaps nicely profitable - again.