Semiconductors

Autonomous Vehicles: Building A Thematic Group

Rapid growth, coupled with regulatory support, has the potential to bring autonomous vehicles (AV) to the streets sooner than some may anticipate.

Casinos & Gaming Crap Out

Semiconductors and Oil & Gas Refining & Marketing were this week's best groups. Managed Health Care and Casinos & Gaming were this week's worst groups.

Paper & Forest Products Grow Into The Lead

Semiconductors and Paper & Forest Products were this week's best groups. Biotechnology and Precious Metals were this week's worst groups.

Steal Leads This Week

Semiconductors and Steel were this week's best groups. Integrated Oil & Gas and Oil & Gas Drilling were this week's worst groups.

Semiconductors Lead This Week

Semiconductors and Semiconductor Equipment were this week's best groups. Household Products and Precious Metals were this week's worst groups.

Semiconductors Charge Ahead

Semiconductors and Precious Metals were this week's best groups and Oil & Gas Exploration & Production and Oil & Gas Storage & Transportation were this week's worst groups.

Semiconductors Lead This Week

Semiconductors and Oil & Gas Equipment & Services post strong week.

U.S. IT Companies’ Global Dominance

A look at U.S. companies’ global IT market dominance, and the key factors that drive the competitive landscape.

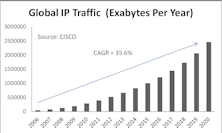

“Old Tech” Profiting From Explosion Of “New Tech” Content?

We identify the “Old Tech” players that will likely reap the benefits from the ever-growing volume of data being generated, stored, and transmitted on line.

Highlighted Attractive Groups

A quick look at the Managed Health Care, Semiconductors, Technology Hardware Storage & Peripherals, and Cable & Satellite groups, all of which caught our eyes this month.

Long Only Portfolios Beating Benchmarks

Select Industries had no group deactivations again this month, but we trimmed a few groups and added Commodity Chemicals. All group holdings currently rate Attractive. Global Industries had no changes. Emerging Electric Utilities, which we added last month, was the second best performing group in March.

Long Only Portfolios Beating Benchmarks

Select Industries had no group deactivations this month, and we made no significant changes to our group weights. All group holdings currently rate Attractive. Global Industries eliminated our longest tenured group, Regional Banks, which we held for two years. We added Emerging Electric Utilities, which is our first EM oriented group since June 2013.

Long Only Portfolios Down For The Month But Beat Benchmarks

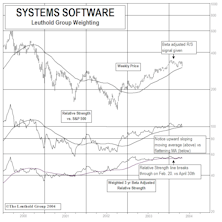

Select Industries had no group deactivations, trimmed Consumer Finance and purchased Systems Software, further boosting our Tech holdings. Global Industries had no group deactivations, trimmed our Reinsurance and boosted exposure to Health Care, Industrials, and Info Tech groups.

Long Only Portfolios Finish 2013 Strong

Select Industries deactivated Specialized Finance. Global Industries deactivated Food & Staples Retail and Road & Rail and purchased Managed Health Care.

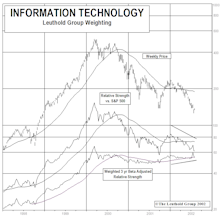

That Time Of Year For Tech??

We have found that technology has the strongest seasonal tendency of any sector during the market’s “bullish” seasonal period of November through April.

Our Work With Beta Adjusted Relative Strength Pays Dividends

Over the last few years, we have been employing a beta adjusted relative strength calculation for high beta groups, along with the traditional relative strength. There are often more revealing signals given by the beta adjusted relative strength, especially in recent years.

Tech Watch

Fundamentals continue to build for technology, but prices yet to react…..Evidence that tech fundamentals are now improving.

Tech Watch

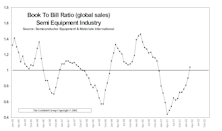

Time to buy Semiconductors? Some early evidence that the prospects for the chipmakers are looking up.

New Select Industries Group Holding: Semiconductors

GS Score improved to Attractive on growth, judgmental and VLT.

New Select Industries Group Holding: Semiconductor Equipment

This highly cyclical group should benefit earlier than the chipmakers in a recovery.

Buying the Semiconductors

Semiconductors being added to both portfolios in early December. Reasons for big jump in Semiconductors ranking are explained which should help readers better understand disciplines and factors in SS Scoring System.

Semiconductors...Could Be A Short Term Strategy

While we have not given up here yet, our tactical purchase of this group could be a very short term play.

Catching a Falling Knife?...Buying the Semi’s

Basically, things are still pretty healthy for the chip makers. This industry has not fallen apart, it’s just not growing at the unsustainably high rate of the past several years.

Technology: Battered, But Still a Leader

The game is still technology, although picking the winners and avoiding the losers is not so easy anymore. Comparing 26 Technology indices to track the sector.