Smart Money

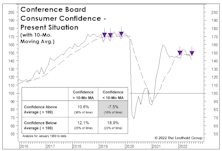

Confidence Cracking?

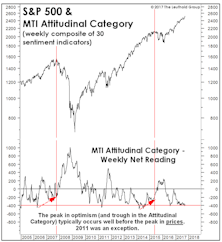

The theory of “contrary opinion” is important to market analysis, but so is an understanding of its limitations. When investor-sentiment surveys dipped sharply in late January, we warned that the declines (which are usually signals to “buy”) might instead mark the beginning of an important trend change.

Watching The “Smart Money”

Of the prevailing bullish arguments, the one that strikes us as the weakest is that there’s “too much pessimism.” Much like in 2000, some pundits disingenuously made that claim before the market rolled over. But at this point, with the market now down big and economic numbers suddenly wobbly, the last thing any bull should want is too much pessimism.

Characteristics Of Major Market Lows

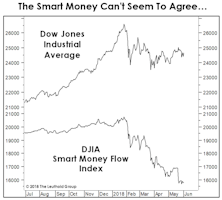

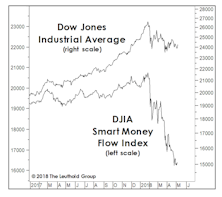

We wrote in the January Green Book that the S&P 500 Christmas Eve low did not have the “right look,” in that: (1) there had been no sign of “smart money” accumulation beforehand; and, (2) downside momentum was also at a new low for the entire correction. Smart money buying is measured by the Smart Money Flow Index, which evaluates trends in first half-hour market action (considered to be more emotional and news-driven), and the last hour of trading (viewed to be more informed and institutional in nature).

December’s Low Didn’t Have The “Right Look”

As the market sunk to a 3% loss on Christmas Eve, we sensed genuine investor panic—at least among the fraction of investors then paying attention.

A Smart-Money Split

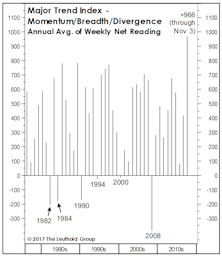

The Supply/Demand category carries the smallest weighting among the five factor groupings in the Major Trend Index, and this weighting is further diminished by the fact that its components rarely line up in a way which loudly proclaims that an “accumulation” or a “distribution” phase is underway. Today is just another of those typically inconclusive times.

The Market Told You So

First quarter profits have been terrific, and this quarter’s will be too. Enjoy them, but remember that the market “paid” you for them many months ago. Don’t submit another invoice…

Stock Market Observations

We remain bullish on stocks but with very limited visibility into 2018.

Thoughts On Sentiment

The MTI’s Attitudinal category has held stable over the last several months, an impressive (and contrarily bullish) feat considering the steady onslaught of new bull market highs.

Score One For The “Smart Money”

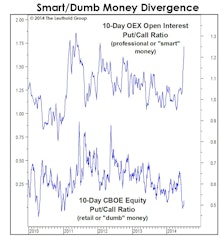

We try to avoid the popular practice of “cherry picking” a few indicators to fit our stock market forecast, a reason we evaluate more than 130 measures in calculating the Major Trend Index. But last month we couldn’t resist highlighting the exciting face-off between the professionals and the public.

The Public And The Professionals Square Off

Two short-term, options-based sentiment measures have just swung to levels consistent with near-term difficulty for stocks. Current reading is the most bearish combination of smart-money caution and dumb-money confidence in 10 years.

.jpg?fit=fillmax&w=222&bg=FFFFFF)