S&P 500 Performance

Has The Stock Market “Eased?”

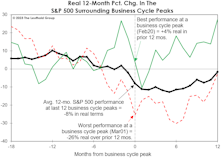

The path of real stock prices in the current cycle looks very different from the typical pre-recessionary track. In fact, based only on the chart of performance in real terms since January 2022, we’d probably believe the economy has recently emerged from recession.

A NASDAQ Conundrum

While we have an above-market weight in Technology stocks in our Select Industries portfolio, it’s doubtful that NASDAQ bulls have drawn much inspiration from these pages of late. But here’s a simple finding to potentially rectify that.

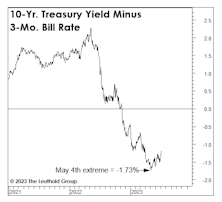

Maximum Inversion?

Factoring in both the duration and depth of the existing yield-curve inversion, it is considered more severe than all predecessors since the 1960s. Even Duke University yield-curve guru, Campbell Harvey, abandoned his January forecast that a recession would be avoided.

Market Odds For The Second Half

With the halfway point of 2023 two weeks away, the S&P 500 has broken out to a 12-month high. The index has accomplished that feat 32 times during the month of June—or exactly one-third of all cases measured back to 1928.

Just A Typical Pre-Recessionary Rally?

Is the stock market disconnected from a souring economy? It might seem that way, and the topic dominated the discussion at the recent Market Technicians Association annual symposium.

.jpg?fit=fillmax&w=222&bg=FFFFFF)