Stock Prices

“PSsss”

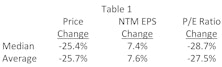

The most brutal bear markets occur when falling earnings are accompanied by shrinking valuations, producing a compound negative effect on stock prices. Investors in 2022 have (so far) avoided this double-whammy in that valuations have taken a hit, but EPS estimates are holding strong. We are intrigued by the notion that 2022’s bear market has, to date, been all about valuation compression rather than earnings weakness. Investors are coping with the problems of the day by letting the air out of bubbly valuations, and this report takes a closer look at the valuation squeeze underlying the current selloff.

Research Preview: P/E Multiple Compression In 2022

Stock market corrections are the result of falling valuations and/or falling earnings, and when both conditions appear together, investors are in for a rough ride. Thus far, the 2022 selloff has been confined to compressing P/E ratios, and we launched a research project to take a closer look at shrinking stock valuations in this market downdraft.

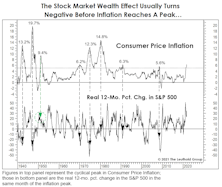

An Inflationary Wealth Effect

Causation between the economy and financial markets is never a clear thing. The optimistic group formerly known as “Team Transitory” believes a peak in the inflation rate is near, presumably clearing the way for even greater P/E multiple expansion than already seen in this cycle.

Powell’s Dovish Accomplice

Last week we argued that U.S. money growth remains way too high to reasonably expect a peak in consumer price inflation during the next few months. At the peaks of the last five bouts of inflation of 5% or more, real growth in the M2 money supply had turned negative in four cases and had slipped to less than 1% in the other one. Today, real M2 is growing at nearly a 7% rate.

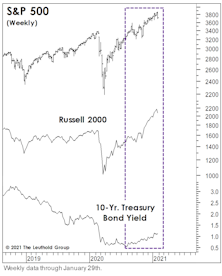

What The Two-Month Stall In Bond Yields Tells Us

The 10-year Treasury yield has absorbed the past two months’ worsening inflation numbers by going exactly “nowhere.” Bond investors seem to be all-in on the Fed thesis that the inflation pickup is just transitory.

During the recent consolidation, however, the Treasury yield showed a subtle change in character—one that suggests there might be more inflation paranoia than meets the eye. The 10-year yield’s daily correlation with stock price movements flipped negative, and then plummeted toward a 21-year low.

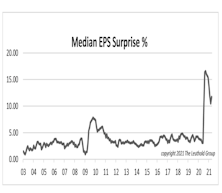

“Surprise” Or “No Surprise?”

Navigating the investment landscape over the past year has been a journey full of surprises. No data other than “earnings surprises” can better demonstrate how unpredictable companies’ financial performance has become.

Stock Market Observations

The speculative peak for this market rally may have occurred in either January (when GameStop and other “left for dead” short candidates soared), or February (when indexes tracking the “newborns”—IPOs and SPACs—both peaked). But even if we knew that for certain, a major peak in stock prices could still be months away.

Earnings Are Back In Focus

Earnings releases (ER) are normally accompanied by large stock-price movements, either to the upside or downside.

Here, we computed the percentage of companies that registered a large move in their stock price on their ER day in the trailing three-month window (500 basis points up OR down). In order to normalize for non ER-day volatility, we computed the percentage of all companies that registered a significant price move on any day during the same period. The difference between the two is shown in Chart 1.

Stocks In The Face Of Rising Yields

With yields on the 10-Yr. Treasury finally breaking above 1.00% last month, the consensus has quickly evolved to the view that stocks and yields can continue to rise alongside one another for a while. Small Caps have shown a decisive performance edge during the recent episodes.

Rising Rates And Rising Stock Prices?

Often, what market pundits like to pass off as bold, contrarian forecasts are merely rationalizations and extrapolations of trends that have already been in place for some time.

.zip.jpg?fit=fillmax&w=222&bg=FFFFFF)

.jpg?fit=fillmax&w=222&bg=FFFFFF)

.jpg?fit=fillmax&w=222&bg=FFFFFF)